ROEMER–SUGAR-8-20-09

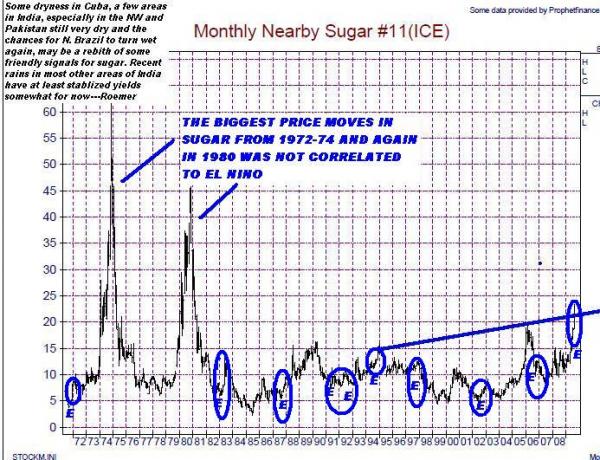

There are some potential bullish weather concerns for sugar prices, even at these levels. True, some important rains have fallen in a few key areas of India and more are on the way, but tomorrow we will discuss this chart below that I put together, and El Nino years (E), plus the following. Sugar prices are following weather developments much more closely this year because of the tight supply/demand situation.

A) RUSSIA/UKRAINE–While the CIS spring wheat regions have suffered from modest drought, it has not made a dent in the large global wheat stocks. Sugar supplies on the other hand, are so much tighter that potentially lower beet and sucrose content from recent dryness further west in Ukraine needs to be noted.

B) SAO PAULO–After a break from the recent rains, more heavy rains may interfere with some sugar harvesting again, so conditions in Brazil may deteriorate again.

C) INDIA/PAKISTAN–We will show some charts and graphs tomorrow on rainfall again in India and plan on doing this at least twice a week. It is likely that India production could fall below 17.5 MMT. Pakistan, although not as important as India, is seeing well below normal rainfall, and their yields will likely be reduced. Once the MJO begins to retreat and weaken, perhaps in the next couple weeks or so, India could turn drier again by September sometime. Speculation—but we will look into this.

D) CUBA—-While not the power house in the sugar market they once were, they are still a major producer. I will discuss how warm heat content in the ocean surrounding Cuba, and the influence of Saharan Dust, etc., will probably keep them mostly on the dry side. Rainfall has been declining there, not a huge problem yet, but if it continues, it will be.

E) El Nino and Sugar price relationship? About 2/3rds of the time, not always, sugar prices rally during El NIno.