Swing Trading With Market Timing Intelligence Using the “Action/Reaction” Theory.

By John Crane

“Man masters nature not by force, but by understanding.” This quote may be about nature, but it also holds true when it comes to trading. Before anyone can master the markets, they need to understand market structure and market behavior. With all the technology and computer power today, traders have come to rely on subjective or lagging indicators to make most or all their trading decisions and have not spent the time to learn and understand the value of past price action and its influence on future market movements. I believe a basic understanding of how market structure and market behavior affect the market will enhance any trading style or methodology.

Before I go further let me define what I mean by market structure. I define market structure as a sequence of patterns that make up a tradable predictive pattern sequence. Most traders will use single price pattern, such as flags or pennants, as their only pattern indicator, but I believe a specific pattern sequence can provide better information as a predictive indicator.

Right behind market structure in importance is market behavior. Understanding how the market should react after a specific market pattern sequence will alert you quickly to a legitimate strong signal or to the possibility that the signal may fail. Combining knowledge of both market structure and market behavior can help identify significant trading opportunities early and prevent trading disasters before they occur.

One of the most power full trading methodologies using the market structure and market behavior is Swing Trading with Market Timing Intelligence using the “Action/Reaction” theory. This methodology uses only the past “action” of the market to make predictive time and price projections with a high degree of accuracy. Instead of going into a long drawn-out explanation of the repetitive natural cycle behavior in the market, I will just use the following chart illustrations and let them speak for themselves.

The first thing that really jumps out about this chart is the lack of data. I am only showing half the chart right side missing. I would also like to point out that I have not identified what market or time frame is represented on the chart. This illustrates that the method can be applied to any market and any time frame. Whether you are a day trader, swing trader, whether you trade commodity futures, equities or Forex, the “Action/Reaction” method can be added to your current trading methodology. That’s right, it can be used as a stand-alone tool or added your own trading approach. It is a truly flexible trading indicator. From the price action and “market structure” shown, I can make a projection of the next market direction, price objective and duration of the impending price move.

It begins at the “reaction swing”. The reaction swing is the balancing point of the cycle. It is the point at which the action (the price action that has already occurred) segment of the cycle ends and the reaction (the future segment of the cycle) is about to occur. By understanding the information provided by the action segment, I can make a predictive projection of the future price action. Here is how it works:

I have marked a pattern sequence I call a Trend Reversal or TR pattern. This pattern sequence is made up of five pivots in a specific order and typically appears at a major high and or low. Since the last trend was up, I can surmise the next price direction is down. Therefore, I have the “direction.” The next step is a time/price measurement from the beginning of the reaction swing marked as (C) back to the beginning of the pattern sequence I marked as (A). Starting at (C) I count the price bars back to the beginning of the TR pattern marked as (A). The count equals 22 bars. I take this number and project forward 22 bars from the end of the reaction swing, marked as (D), to identify where there could be a future reaction in the market that could result in a possible change.

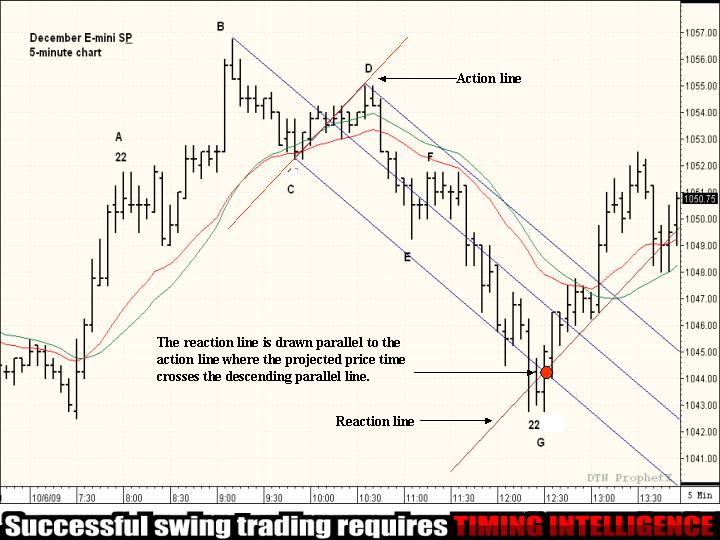

Now that I have the direction and duration of the upcoming price move, I want to know the probable price target objective. To find the price projection, I turn to the Andrew’s Pitchfork and anchor it at the high of the TR pattern, marked as (B). The two parallel lines are drawn from the high and low of the reaction swing marked as (C) to (D). I am most interested in the center line known as the “median line.” I use this as a momentum indicator to determine strength or weakness of the market. Using the information I already derived from the time/price measurement, I count forward the 22 bars and mark the median line and the lower parallel line. At this mark, I draw a line parallel to the line drawn from (C) to (D) by the Andrew’s Pitchfork. This sloping line is called the “reaction line” and will be the price target objective. I have now had my future projections for both the time and price of the impending price move. It is time to see what unfolds over the next 22 price bars.

After a short-term pause between price bars #6 and #8, the market resumed the downward trend and crossed over to the weak side of the median line on price bar #15. This indicates more weakness and therefore, the reaction line is lowered to where the time projections intersects the lower parallel line to provide a new price target objective.

The final result of my time and price projections is shown on the following chart of the 5-minute e-mini S&P chart. The reaction segment of the cycle traded lower over the next 22 5-minute price bars posted the lowest losing price of the market swing on the 22nd price bar, but not until the market had reached the reaction line target objective. Both time and price objective had been projected 1 hour and 40 minutes earlier. This effectively ended the cycle and the market promptly reversed. The cycle had ended and a new cycle was about to begin.

This is a prime example of the importance of understanding market structure and market behavior. Since buyers and sellers are the true drivers of the market and human fear and greed will never change, the emotional cycles will always exist in a measurable and definitive way. With the “Action/Reaction” theory and Market Timing Intelligence you can use these patterns sequences and market behavior to enhance your current trading approach or as a stand alone indicator. This methodology is the foundation of the daily trade recommendations made in the Traders Market Views Swing Trade report and also for the highly acclaimed RT Swing Trade software.

At Traders Network we offer a 30-day free trial of the Traders Market Views Swing Trade report and the RT Swing Trader software. We will show you how to make your own market projections or just allow the software to do it for you. After learning more about the “Action/Reaction” theory, I guarantee that you will never look at the markets the same way again.

For more information or to request a 30-day free trial of the Traders Market Views newsletter or the RT Swing Trader program, call 1-800-521-0705 or visit our website at www.tradersnetwork.com.