Commercial real-estate, once considered the next shoe to drop in the financial crisis, continues to make naysayers look silly as the iShares Dow Jones US Real Estate etf (NYSE:IYR) closed at 52-week highs yesterday.

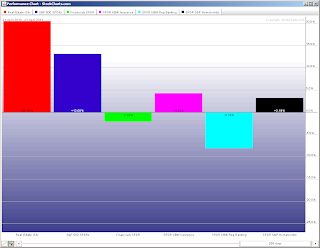

Behind sales growth from retailers, strong corporate balance sheets and decreasing unemployment, the commercial real-estate sector and etf has quietly outperformed the SPDR S&P Homebuilders (NYSE:XHB), the SPDR KBW Insurance (NYSE:KIE), the SPDR KBW Regional Banking (NYSE:KRE) and the Financial Select Sector SPDR (NYSE:XLF) over the last year.

(See performance chart below)

Simon Property Group, Inc. | NYSE:SPG | 1-year perf: +26.96%

Weighting in IYR: 7.99%

Public Storage | NYSE:PSA | 1-year perf: +26.84%

Sector: Financial | Industry: REIT – Diversified | Country: USA | Market Cap.: 19.15B

Weighting in IYR: 3.98%

HCP, Inc. | NYSE:HCP | 1-year perf: +23.02%

Sector: Financial | Industry: REIT – Healthcare Facilities | Country: USA | Market Cap.: 15.49B

Weighting in IYR: 3.58%

Boston Properties, Inc. | NYSE:BXP | 1-year perf: +26.42%

Sector: Financial | Industry: REIT – Office | Country: USA | Market Cap.: 14.35B

This chart illustrates the outperformance of Commercial RE against SPDR S&P 500 (NYSE:SPY) and other finanical groups over the last year.

This chart illustrates the outperformance of Commercial RE against SPDR S&P 500 (NYSE:SPY) and other finanical groups over the last year. Sector: Financial | Industry: REIT – Diversified | Country: USA | Market Cap.: 2.49B

Digital Realty Trust, Inc. | NYSE:DLR | 1-year perf: +2.80%

(Up +15.28% over the last 3 months)

Sector: Financial | Industry: REIT – Industrial | Country: USA | Market Cap.: 5.56B

*DISCLOSURE: None

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.