A backspread is an option trading strategy that enables a trader to profit when the underlying security is volatile. Though these strategies are fairly simple to construct, they are complex to trade. Unless a trader has a good feel for this option strategy, it is hard to make money trading backspreads.

A backspread involves selling one option and buying two or more options on the same underlying in the same expiration month, but with different strike prices. For example, in IWM a call backspread could be established by selling 1 December 45 call at 4.25 and buying 2 December 50 calls at 1.85. Here, the trader would collect a net of $0.55 when putting on the trade (a credit of $4.25 from the 45 call and a debit of $3.70 from the two 50 calls).

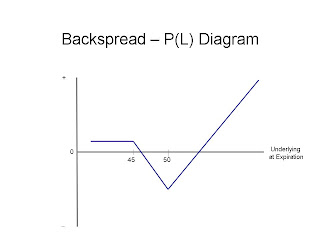

Most non-professional option traders tend to think about their position in terms of what happens if the option position is held until expiration. This is easily visualized with the help of a profit and loss [P&(L)] diagram like the one shown along with this blog.

Here, if both calls are out-of-the-money at expiration they expire and the trader makes $0.55. If just the 45 calls are in-the-money at expiration, the call acts like short stock and becomes more of a loser as IWM approaches $50. Above $50, with both options in-the-money, the trader ends up net long one call which acts like long stock. The higher the underlying, the higher the profits. In this two-dimensional representation, the backspread looks easy–you don’t want IWM around $50 at expiration. You’d prefer it rallies sharply. You’re OK with it falling sharply.

Though a picture may say 1,000 words, this picture doesn’t say enough to fully explain the backspread. First, unless IWM really rises a lot (it was at $46.14 when I created this example) it’s not a great trade. In fact, with IWM at $50 at expiration, the trader loses $4.45 ($50 minus $45 minus $0.55 credit). That’s a lot more than the $0.55 that can be made if IWM is below $45 at expiration. The only way this makes sense is if the trader is strongly bullish. And the fact of the matter is a superior position can usually be created just by buying a call.

So, why do traders fancy backspreads so much? When backspreads are traded successfully, it is usually by a gamma-scalping professional trader. This means the trader scalps the underlying by hedging the position delta thereby locking in profits to offset time decay. For most retail traders, that last sentence might as well have been written in Greek. And that is (if you’ll excuse the cutesy pun) what the trader needs to focus on with backspreads: greeks. Unless you are fully boned up on option greeks, you’re probably better off leaving backspreads to the more experienced traders.