We bought the dip.

That is to say we took the money and ran on our weekend shorts and we even picked up the DIA June $124.75 calls at $1.35 – just in case we get a little pop this morning. But, if that little pop is based on knocking down the dollar, AGAIN, then we’re certainly going to be shorting this morning because the Dollar simply needs to be higher at this point and it’s pretty clear that the Euro is not a “safe” alternative and to think that means the Yen (now embedded with cesium!) is the way to go is fairly ridiculous. Australia is not safe because it’s tied to Asia and Switzerland isn’t safe because it’s tied to Europe and too small anyway and the Canadian Loonie is still my favorite currency but we bailed at $1.05 when we flipped to the dollar after an excellent 10% run from our pick.

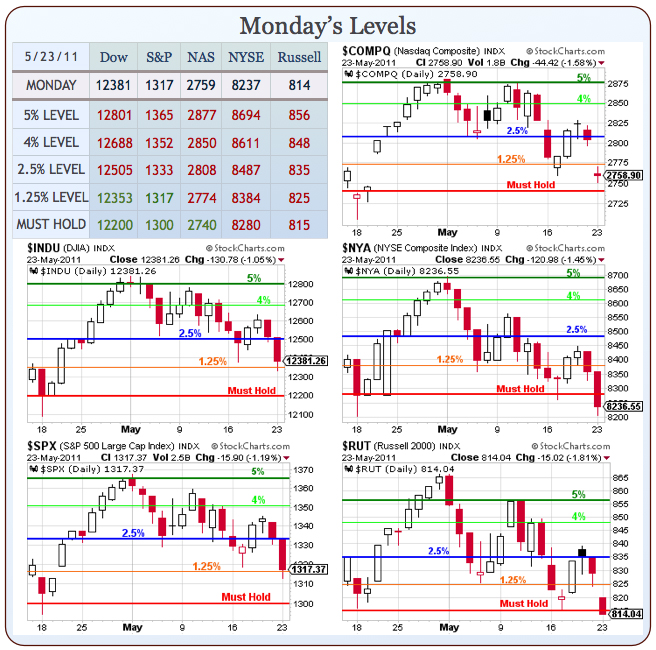

As I said yesterday, everything is proceeding as I have foreseen it and we are having a good old time playing this volatile market that is actually doing a fantastic job of obeying our 5% rule. We are simply following through on the pattern we saw forming up in late April and we went short into that last weekend and on Monday, May 2nd, I pointed out how TERRIBLE the indexes looked when priced in silver (which we were short at the time, now long again).

On May 2nd, we were down 50% over 12 months priced in silver. Now here is something my Members will completely understand and find funny – we have just completed a perfect 20% bounce on our indexes when priced in Silver:

It really shouldn’t be this easy to predict market moves, should it? At the same time, of course, we drew out the 5% lines on the top chart and made our bets expecting to test those red lines at the bottom. Yesterday, we got our test on the Nasdaq (close enough) the NYSE and the Russell, with the Dow and S&P holding their 4% lines. Today is not a day to make a call but if the NYSE can’t retake 8,280 today, then it is, once again, going to be the anchor that weighs down the other indices.

IN PROGRESS