What a crazy market!

What a crazy market!

I already sent out a morning Alert to Members titled “Busy Morning Already – Dow Futures Short” with a trade idea to short the Dow below the 11,000 line, which is a nice, fat resistance line to take advantage of. As I said to Members: “That’s such a good line, there’s really no point in playing anything else!” As I’m writing this, at 8am, the Dow Futures already dropped to 10,930 and, at $5 per point per contract, that’s a nice $350 per contract winner and a good enough way to start our morning as we can take that money and run.

We mainly we sat on the sidelines yesterday, not buying into the rally but doing a little bottom-fishing as things pulled back. This morning’s move up came from a decent Asian session and good PMI numbers out of Europe which boosted the Pound and Euro and dropped the Dollar down to 73.63 (from 74.25) but now the Dollar climbed back to 73.78 and that’s what caused the dip we expected in the Futures.

Still, we are probably going to have a nice open and we can now afford to watch and wait again while we decide which side to deploy our $350 per contract profits on. I published a full list of long-term puts earlier this morning for Members, 17 stocks and ETFs that should make a nice payout if Bernanke fails us this week and tanks the markets. As we are very much in cash, these are more speculative bets than portfolio protection but they have an advantage over our recent Disaster Hedges of being easier to trade in and out of with 3 of Friday’s picks (from that morning’s Alert) making over 20% in 24 hours already.

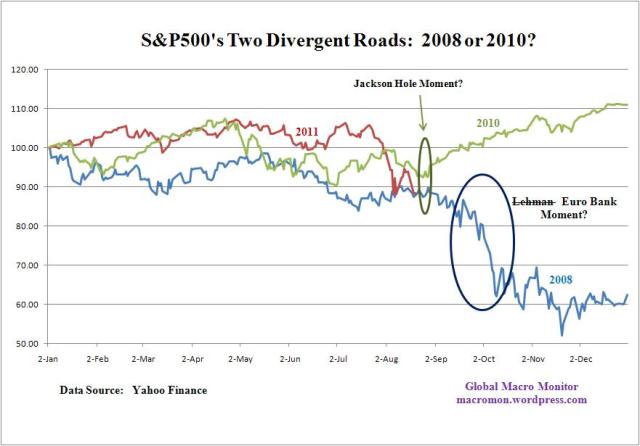

Make no mistake about it, we’re heading into a MAJOR inflection point this week with Bernanke’s Friday morning speech from Jackson Hole. As you can see from the chart on the right (thanks Barry!), it won’t take much of a push to send us off a 40% cliff while ONLY QE2 saved us last September.

Make no mistake about it, we’re heading into a MAJOR inflection point this week with Bernanke’s Friday morning speech from Jackson Hole. As you can see from the chart on the right (thanks Barry!), it won’t take much of a push to send us off a 40% cliff while ONLY QE2 saved us last September.

THAT is why we are picking up our long-term shorts NOW – just in case. It’s also why we remain CASHY & CAUTIOUS because, if we’re going up – we have a lot of room to run and, if we’re going…