And the nonsense continues…

And the nonsense continues…

I don’t even have to write today’s column, I wrote all about how silly the market move was last Tuesday and, if you look at a 10-day chart, you’ll notice that they are running the same bull-trap pattern they ran last Monday and Tuesday which allowed me to predict in yesterday’s 9:21 Alert to Members that a positive move in gold, oil and copper (we got all 3) would take us up to Dow 9,535, S&P 1,032, Nas 2,070, NYSE 6,768 and RUT 586. At the day’s end, we found ourselves at Dow 9,599, S&P 1,040, Nas 2,068, NYSE 6,795 and Russell 591 so past our bounce zones, except on the Nasdaq, who used to be our leader.

After going wisely neutral into the weekend, we may have gone a little too bearish yesterday as we don’t have the same catalyst today (Consumer Confidence) to take down the market that we had last week. We have another Consumer Confidence report this evening at 5pm but that doesn’t stop the pump-monkeys from attacking the dollar this morning as they float rumors that the dollar will be replaced by OPEC as an exchange currency, which sent the dollar down to 89 Yen and $1.475 to the Euro and $1.605 to the Pound – all based on nothing but a rumor.

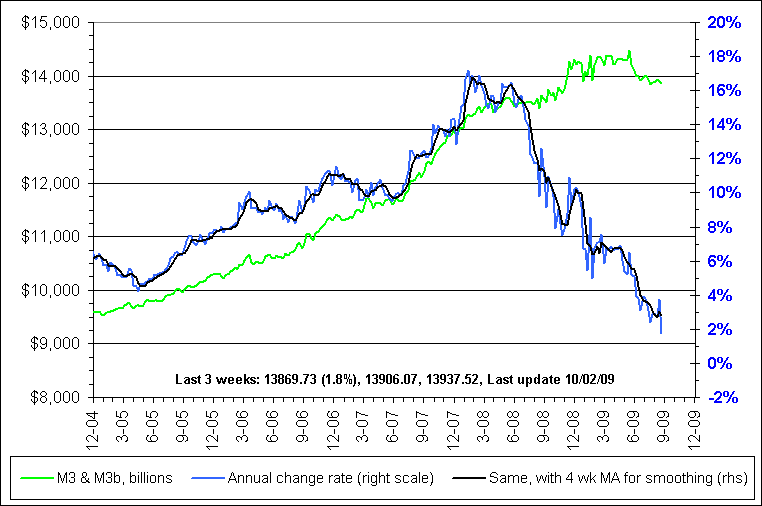

Aside from making someone sensible wonder why oil-producing nations, who hold $1.5Tn in reserves, would want to devalue their holdings, it also would boggle the mind of people who can do math (and the market manipulators count on the fact that you can’t) who might wonder where the extra $2Tn worth of Euros is going to come from to pay for a year’s worth of global oil at $70. I know $2Tn doesn’t sound like a lot of money these days but there are only $727Bn Euros in circulation on the planet Earth. The entire M3 supply of Euros (all of them) ever created is, as of April, 9.5Tn so is the plan to divert 20% of all the Euros on Earth to the oil trade or are they just going to print 20% more? Heck, why not? The M1 supply of Euros is already up 13.6% for the year and are trending to be up 21.9% at the rate of growth in Q3.

There is already a supply of 14Tn Dollars in the world and $2Tn worth of them are exchanged for oil during the year and $3.5Tn is sitting in bank accounts and Trillions more…