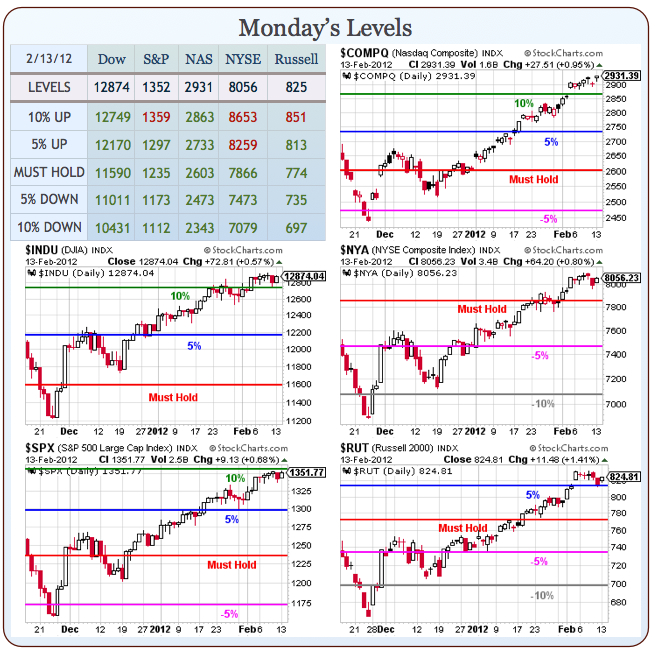

We are right on our 10% lines for the Dow, S&P and Nasdaq.

We are right on our 10% lines for the Dow, S&P and Nasdaq.

The S&P rests just 6 points under our final line of resistance on the Big Chart and the Dow and Nasdaq have been over the line since the beginning of the month. Now it’s up to the S&P to put up or shut up as we test 1,359, which is exactly were we expected to top out on this rally – only we expected it months from now.

We went over the Dow components previously and determined they were a bit stretched at 12,749 and the Nasdaq would be under the mark if not for AAPL – and a sell-off there along with an overall pullback in the Nasdaq can lead to an extremely rapid decline in the index. Obviously it seems like my timing is off with AAPL just hitting $505 yesterday but, on a run from $420 pre-earnings, that’s 20% and certainly due for a $16 pullback to test $485-490 in the very least.

That’s 3% and AAPL is 10% of the Nasdaq so 0.3% of a drag coming there is very likely and I have long been pointing out to Members that the Tech sector – minus AAPL and AAPL partners – is not having a very good year. That’s why the rally does not make sense – AAPL is strong but many, many other techs are weak yet they have all been moving in lock-step higher and higher and higher – up 450 Nasdaq points (18%) since Thanksgiving – despite 70 out of 100 of the components having lower revenues and lower earnings than they did a year ago.

That’s 3% and AAPL is 10% of the Nasdaq so 0.3% of a drag coming there is very likely and I have long been pointing out to Members that the Tech sector – minus AAPL and AAPL partners – is not having a very good year. That’s why the rally does not make sense – AAPL is strong but many, many other techs are weak yet they have all been moving in lock-step higher and higher and higher – up 450 Nasdaq points (18%) since Thanksgiving – despite 70 out of 100 of the components having lower revenues and lower earnings than they did a year ago.

GOOG and AMZN both missed, with AMZN earning less than half of what it earned in Q4 of 2010. Financials are down 21% from last year’s Q4 reports – what is everyone so excited about? That sector is the largest in the S&P! Overall, earnings in the S&P are up 2.7% from Q4 2010 – a drastic slowing of growth from the 33% gains we had over Q4 2009. Taking out the drag of the Financials but leaving in AAPL, S&P earnings growth is 8% over last year.

As you can see from David Fry’s SPY chart above – we’re already 10% higher than we were last February and last February we certainly thought (forward-pricing…

As you can see from David Fry’s SPY chart above – we’re already 10% higher than we were last February and last February we certainly thought (forward-pricing…