EUR/USD

The Euro and dollar have been trapped within very narrow ranges during the holiday period with low trading volumes the most notable feature. There has been Euro resistance towards the 1.31 area while there has been no move to test support below 1.30 with liquidity inevitably extremely low.

The US economic data has maintained the generally more favourable trend seen over the past few weeks. There was a stronger than expected increase in durable goods orders of 3.8% for November, although the core increase was more subdued at 0.3%. There was also an increase in consumer confidence to an 8-month high of 64.5 for December from a revised 55.2 previously which maintained hopes that a firmer tone in the employment market will have a positive impact on spending trends during the next few weeks. There were expectations of stronger housing activity, although there was still a 3.4% annual decline in prices according to the latest Case-Shiller index.

In the latest ECB liquidity auction, there was a record amount of funds placed on deposit at the central bank at over EUR411bn. Coming after the huge ECB long-term repo operation last week, there was increased speculation that a lack of trust would prevent the funds have any beneficial impact on underlying banking-sector operations.

There were tensions ahead of Italian bond auctions this week, especially as 10-year Italian yields had again moved above the important 7.0% level. A disappointing auction would increase fears that Euro-zone instability will again dominate the early part of 2012.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar has been unable to make any headway against the yen with selling above the 78 level and it dipped to test support near 77.70 even with a solid set of economic data releases which suggests solid underlying yen demand.

The latest Japanese economic data was significantly weaker than expected with household spending falling 3.2% in the year to November from a 0.4% decline previously. There was also a 2.6% decline for industrial production following a 2.2% increase in October while retail sales also declined 2.3%.

The US Treasury declined to nominate China as a currency manipulator in the latest report which may help ease immediate tensions slightly, although underlying stresses will continue, especially if exports decline.

There was also criticism of Japanese currency intervention by the US Administration which will make it more difficult for Finance Ministry to justify further intervention.

Sterling

Sterling found support on dips towards the 1.56 level against the US dollar on Friday and gradually moved higher with a test of support towards the 1.57 level as underlying Sterling demand remained firm with the Euro unable to regain the 0.84 level.

The latest economic data was weaker than expected with a weaker than expected reading for mortgage approvals while there was also a decline in services index for October which increased doubts surrounding the fourth-quarter outlook as there were further concerns surrounding the economic outlook with fears that there will be a further recession.

Safe-haven considerations will remain very important in the short term and there is the potential for further defensive inflows into the currency given underlying fears surrounding the Euro-zone outlook.

Swiss franc

The dollar was unable to break above the 0.94 level against the franc during the holiday period and drifted back to the 0.9330 area as the Euro was unable to make a move above the 1.2250 level with a move back to the 1.22 area.

The latest UBS consumption index was weaker than expected with a reading of 0.81 for November from 0.90 previously.

Markets will remain uncertain over the outlook for safe-haven flows and there will be further expectations that the National Bank will engage in further verbal intervention to prevent fresh appreciation.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

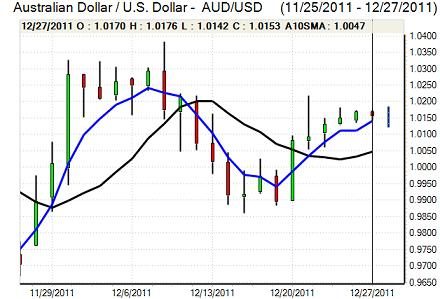

Australian dollar

The Australian dollar found support on dips to the 1.0130 area against the US currency and pushed to a high around 1.0180 area, but there was no attack on resistance levels in very thin trading conditions with Australian markets closed for holidays.

There were further doubts surrounding the Chinese economic outlook which dampened demand for the Australian currency, although uncertainty was a dominant influence. Markets will stay on alert for comments from the Reserve Bank early in 2012 to help assess whether interest rates will be cut again.