EUR/USD

The Euro was confined to narrower ranges on Wednesday as technical factors tended to dominate with selling pressure an any approach to the 1.33 area against the dollar while retreats continued to attract firm buying support.

Greek negotiations continued during the day while there were a series of rumours following the release of a framework document on how to reach agreement with the troika. After protracted negotiations, Prime Minister Papedemos announced that there was an outline deal on all aspects of the agreement except for pensions with the LAOS party opposed to any reductions in primary pensions

Tensions will inevitably remain high on Thursday with the Euro-group scheduled to hold a meeting on Thursday evening where they will discuss the potential Greek troika and PSI deal. There will be initial relief if some form of agreement can finally be reached, although confidence in the process will remain extremely weak.

The ECB will also be an extremely important focus during the day even though the consensus is for interest rates to be left on hold at 1.0%. Markets will be watching comments from Bank President Draghi very closely to assess whether there are hints over future rate cuts, together with the commitment to bond purchases and long-term repo operations. The ECB stance on its holdings of Greek bonds will also be very important.

There were no major US economic releases during the day which maintained a focus on Federal Reserve comments. Regional Fed president Williams stated that further quantitative easing would be a close call and took a generally dovish tone while Lacker stated that further easing was unlikely. Markets will maintain expectations of a dovish tone given the overall FOMC composition.

The Euro found support below 1.3250 in choppy trading and moved back to the 1.3300 area in Asia on Thursday as dollar sentiment remained weak.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar came under selling pressure in Europe on Wednesday and dipped to lows near 76.70 with reports of exporters selling the US currency. There was a recovery back to the 77.15 area in Asia on Thursday as yen demand dipped again.

There were further intervention warnings from Finance Minister Azumi and, although they were treated with scepticism, there was still caution over buying the yen aggressively as it retreated on the crosses.

The Japanese economic data was weaker than expected with machinery orders falling 7.1% for December following a 14.8% increase previously. Companies are expecting a recovery in the first quarter of 2012, although recent profit warnings from key electronics companies could put this in doubt.

Sterling

Sterling was unable to hold above 1.59 against the dollar on Wednesday and dipped sharply lower with a test of support near 1.58 as the UK currency also lost ground against the Euro with a retreat to the 0.8380 area. The Euro has regained some poise which will tend to dampen safe-haven flows into the UK currency, at least in the short term.

There was caution ahead of the Bank of England interest rate decision given market expectations for further quantitative easing even though these expectations have been scaled back over the past week. The near-term Sterling direction will be strongly influenced by the extent of any additional bond buying and an aggressive stance would tend to trigger initial selling.

There were broadly supportive comments from Standard & Poor’s, especially on the flexible exchange rate which should help keep any rating-cut fears at bay in the short term.

Swiss franc

The dollar found support in the 0.91 region against the franc on Wednesday, but was unable to make significant headway with gains capped near 0.9150 . The Euro was trapped near the 1.21 area as it failed to capitalise on Tuesday’s rebound.

Markets will remain on alert for fresh National Bank action, especially as there are still market rumours that the Euro minimum level will be lifted.

The ECB interest rate decision will also be watched closely and the franc will tend to regain some ground if there is a dovish stance by the bank.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

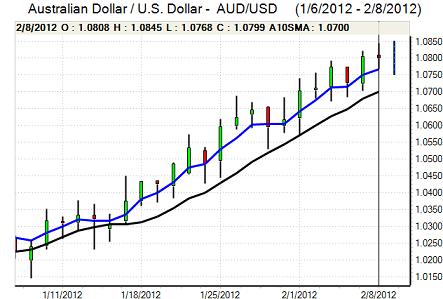

Australian dollar

The Australian dollar peaked in the 1.0840 area against the US currency on Wednesday and dipped back to test support below 1.08 as longer-term selling interest increased. There was further volatility in Asia on Thursday as the Australian currency dipped lower following the higher than expected Chinese CPI release before finding support below 1.0750 and rallying again

Underlying risk appetite is still being support by expectations of a dovish US Federal Reserve stance and further easing by the ECB which is helping to maintain a flow of funds into higher risk and higher yield instruments such as the Australian dollar.