Wow, what a Monday!

Wow, what a Monday!

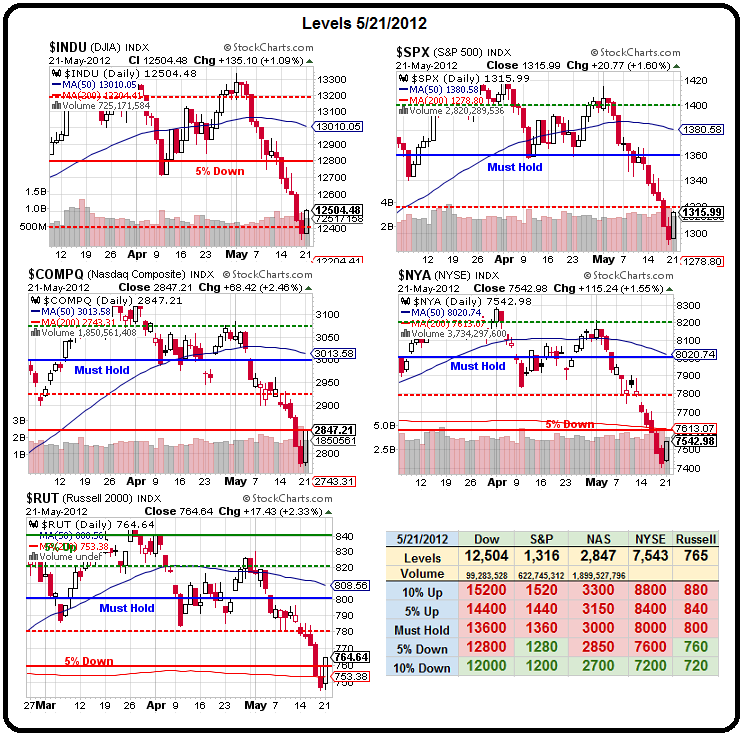

The Nasdaq and the Russell already hit our 2% bounce goals and the Dow needs another point with just half a point making the mark for the NYSE and the S&P – not bad for a day’s work…

EVERYONE is TALKING about bailouts and easing but, so far, no concrete action has been taken and we don’t believe we can get more than a strong bounce (40% retrace of the drop) without ACTUAL stimulus coming through. Those lines would be:

- Dow – 12,750 (12,540 is 20% retrace/weak bounce)

- S&P – 1,343 (1,319)

- Nas – 2,900 (2,840)

- NYSE – 7,720 (7,560)

- RUT – 780, (765)

As you can see from the Big Chart, the Nasdaq stopped dead at their -5% line at 2,850 so we’ll be watching that one very closely and the S&P is just under its -2.5% line at 1,320 so those are our major goals for the day along with turning the Russell and the other weak bounce lines green. Those are the 2% bounces we expected in yesterday’s post but we certainly didn’t expect them in one day!

We had gone into the session expecting to flip more bearish after betting on the bounce Friday afternoon but it was a very strong day overall and none of our warnings (see Morning Alert) were tripped so we ended the day a little more bullish as we tweaked our FAS Money Portfolio even more bullish by uncovering our primary January bull call spread. On the other hand, we left our bear hedges in place on the $25,000 Portfolio, so we’re not ready to go all the way on our first bullish date.

We had gone into the session expecting to flip more bearish after betting on the bounce Friday afternoon but it was a very strong day overall and none of our warnings (see Morning Alert) were tripped so we ended the day a little more bullish as we tweaked our FAS Money Portfolio even more bullish by uncovering our primary January bull call spread. On the other hand, we left our bear hedges in place on the $25,000 Portfolio, so we’re not ready to go all the way on our first bullish date.

All three of my stock picks from this week’s Stock World Weekly gave us the entries we were looking for and some nice gains yesterday as CHK opened at $14.25 and finished at $14.91 (up 4.6%), HPQ opened at $21.42 and jumped to $21.89 (up 2.1%) and XLF gave us our $13.77 entry but is still playable at $13.90 (up 1%) and, of course, our aggressive FAS Money move was to take advantage of the lagging XLF index.

Of course the more fun way to play XLF would be our trade idea from yesterday’s Member Chat, which was to sell the Jan $12 puts for .75 and buy the Jan…