No way to slow down.

No way to slow down.

That line from Tull’s “Locamotive Breath” keeps playing in my head as I look at these rumor-driven markets and contemplate that we MUST keep going higher – or we will fall. On the whole, that’s not generally a winning long-term investing premise BUT – it does so happen to be the entire principal on which space travel is based so let’s not discount it entirely.

As you can see from David Fry’s SPY chart, yesterday was not impressive at all from a volume perspective and we are not big fans of gap-up days in the first place, where pre-market shenanigans set the tone for the day. As David said:

A much overlooked but important factor driving stocks higher is short interest is as high as March 2009 lows and near the highs of June 2010. This can alone stimulate HFT algos to launch short squeeze trades much in evidence Monday. Those HFT haters in the financial media will be silent about them when markets rise.With risk plays back on gold was sold again while the dollar was flat. Bonds lost some ground as investors switched back to stocks while crude oil was higher but most other commodities were mixed. Volume was much lighter occasioned by Irene which made HFT trading easier. Breadth per the WSJ was quite positive and we might even be short-term overbought now.

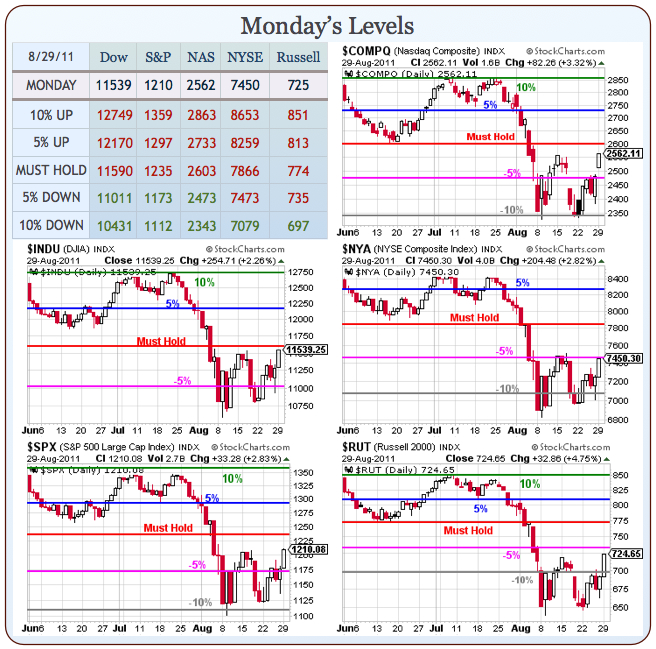

We are short-term overbought. Any time we have a 2.5% move in a single day with no pullback, that’s overbought but it’s the kind of overbought we expect using our 5% Rule and the real trick is “How do we handle the pullback,” not “do we pull back.”

We are short-term overbought. Any time we have a 2.5% move in a single day with no pullback, that’s overbought but it’s the kind of overbought we expect using our 5% Rule and the real trick is “How do we handle the pullback,” not “do we pull back.” Until the markets move MUCH higher, higher than our 10% lines, they will continue to be subject to gravity. In the absence of news, that gravity tends to center or our Must Hold lines and, as I said yesterday, we have been playing since last week’s lows for a move in our indexes over the center of that W pattern that is now clearly forming on our Big Chart.

We are, so far, simply following the exact pattern we predicted as well as the timing we predicted – way back on August 9th (“Turnaround Tuesday – Waiting for the Fed“), when it looked nothing like a W…