What a crazy ride!

What a crazy ride!

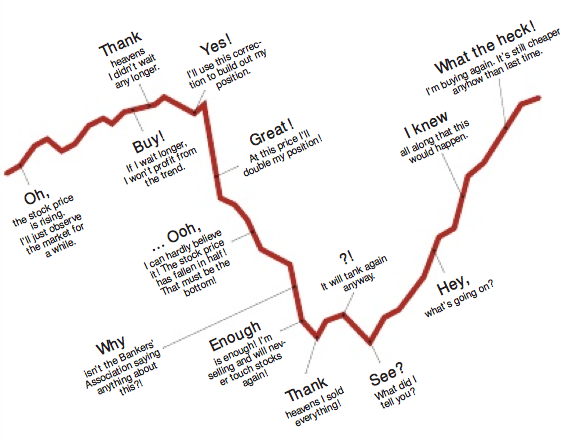

The chart on the left is a take on market sentiment but it’s the kind of mood swings that should be talking place over a span of weeks or months, not HOURS – like it has been recently.

Volatility has gone completely crazy this year, to the point where a stock like BKS has an AVERAGE intraday spread of 8.3%. 8.3% used to be considered a big year for a stock – now it’s considered lunch…

Even worse, BKS doesn’t even top the list: GMCR (8.7%), PDC 8.5% and PCX (8.4%) as well as BAS (8.2%) all have AVERAGE daily price swings above 8% and Bespoke has a list of 50 stocks (not even the ultra ETFs) that move 6% or more in the average day.

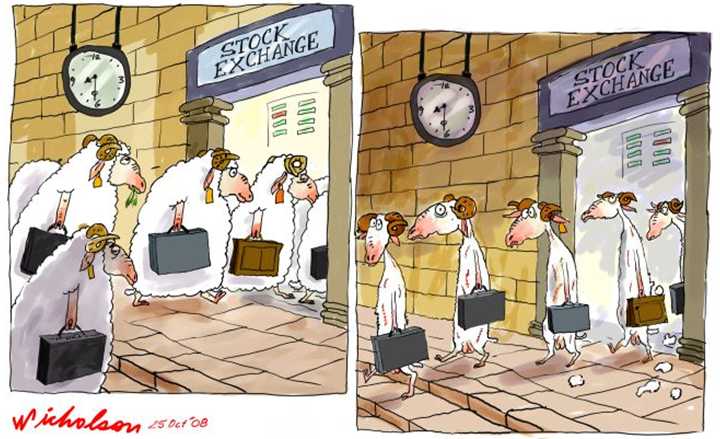

MS is one, so is X – as well as JEF, NFLX, AMED, ANR, FSLR, NILE, ZEUS, LZB (really Lazy-Boy?!?), TEX and HAYN among the well-known names that swing up and down like penny stocks in the “average” day. This is not rational. MS has a $32Bn market cap – do we really think the value of MS jumps up and down $1.8Bn a day based on anything other than sheeple stampeding in and out of the stock?

MS is one, so is X – as well as JEF, NFLX, AMED, ANR, FSLR, NILE, ZEUS, LZB (really Lazy-Boy?!?), TEX and HAYN among the well-known names that swing up and down like penny stocks in the “average” day. This is not rational. MS has a $32Bn market cap – do we really think the value of MS jumps up and down $1.8Bn a day based on anything other than sheeple stampeding in and out of the stock?

This creates tremendous opportunities for Fundamental investors as well as option SELLERS, which is what we prefer to be as – whether the market goes up or down – there is always someone who thinks it will go much lower or much higher and they are willing to give us lots of money to bet that they are right. All we have to do is BE THE HOUSE and take bets on both sides and wait for those times when nothing happens and we cash out both ends of the trade (kind of like bookies when a team wins but doesn’t beat the spread).

That’s right, bookmaking is illegal (unless you are Steve Wynn) but ordinary citizens like us can SELL options to suckers who think they are smarter than the markets. I was on BNN yesterday and I’m sorry I didn’t catch the guy’s name but I guess he was another host and we were discussing using offsetting short puts to lower the next cost of our GNW and AXP spreads and he said “but retail investor does have to understand (the risks)”…

That’s right, bookmaking is illegal (unless you are Steve Wynn) but ordinary citizens like us can SELL options to suckers who think they are smarter than the markets. I was on BNN yesterday and I’m sorry I didn’t catch the guy’s name but I guess he was another host and we were discussing using offsetting short puts to lower the next cost of our GNW and AXP spreads and he said “but retail investor does have to understand (the risks)”…