Wheeeeeeee – that was fun yesterday!

Wheeeeeeee – that was fun yesterday!

We love a BS rally in the mornings, we got our double down on the USO puts as oil rose to $102.44 in frenzied (and totally BS) buying, which we expected in yesterday’s post – just not to that level of stupidity… I called for profit taking on the oil futures at 9:38 in Member chat and we got out right at the day’s low at $100.80 with a nice, quick .80 profit off the $101.60 line, which is $800 per contract.

We had the USO puts to make sure we didn’t miss out on a bigger down move and added some weekly puts that made a quick 20%, got out of those and kept the July puts (of course) but then oil went nuts and gave us a great short entry at the $102.25 line just after noon and from there we fell with little drama, all the way down to $101.30 at 2 and stopping out at $101.50 on the bounce was a very nice .75 gain ($750 per contract) and, with 270,000 open contracts, I hope everyone followed our strategy and stuck it to the speculators for a good $418M on the day!

Early this morning (5:30), we got another shot at a cross below $101.60 to short and got a nice .40 drop before stopping out at $100.25 for a quick .35 gain again (see the pattern) and now (8am) oil is down at $100.90 and we finally decided to take a poke at the long side (yes, I know, we are so ashamed to be participating) but all the better to flip short with on the silly pump job we expect into the open. If they want to take it lower (maybe back at our $100.60 line), we’ll be happy to stop out and go long again at lower strikes and, if they aren’t going to pump oil up into the weekend for a change – well, that’s what the July puts are for!

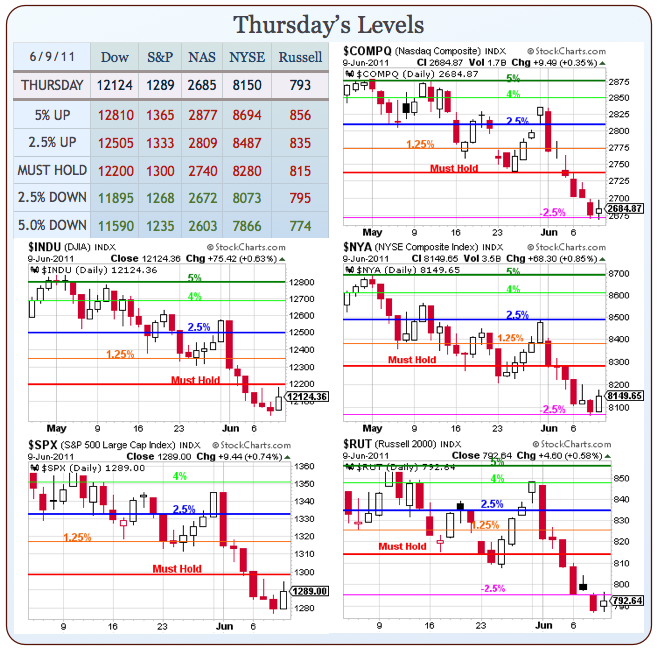

It was close but no cigar for the Russell yesterday as they tried to recapture that 795 level and that kept us from falling for the silly rally they tried to put up in the afternoon. Notice how well the Bots are behaving and following our pattern to a T. Unfortunately, it’s Friday and there’s too much danger of something very…

It was close but no cigar for the Russell yesterday as they tried to recapture that 795 level and that kept us from falling for the silly rally they tried to put up in the afternoon. Notice how well the Bots are behaving and following our pattern to a T. Unfortunately, it’s Friday and there’s too much danger of something very…