EUR/USD

The Euro pushed above 1.40 against the dollar during Wednesday, but was unable to sustain the advance. Initial support from approval of the Greek budget deficit reduction plan was countered by a generally pessimistic tone from EU member Almunia who stated that the Greek position was very difficult. There was also a decision by the Greek unions to back a strike plan which undermined confidence in the government’s ability to deliver spending cuts.

The very fragile sentiment was illustrated by the Euro falling sharply on rumours of a Spanish credit-rating downgrade and confidence is likely to remain fragile.

The US economic data was generally close to expectations with the ADP report, recording a 22,000 decline in private-sector jobs for January after a revised 61,000 drop for the previous month. The ISM index for the services sector rose to 50.5 for January from 49.8 previously. There will be some relief that the index moved above the 50 threshold, but it is still weak in historic terms and illustrates that the services sector will be a source of vulnerability.

The ISM employment index edged higher, but remained trapped substantially below the 50 level. Ahead of Friday’s payroll report, the employment data overall will maintain expectations of a gradual improvement in the labour market, but the sector remains weak.

Ahead of Thursday’s council meeting, there were expectations that the ECB would not be able to signal any further tightening of policy due to fears surrounding Greece and with risk appetite generally weaker, the Euro dipped sharply to test support below 1.39. The Euro will gain some support if there is a firm ECB tone, but any gains may prove unsustainable.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was able to find support below 90.40 against the Japanese yen during Wednesday and pushed higher to test resistance levels near 91 in local trading on Thursday with the generally firmer US currency helping its tone against the yen.

The Japanese currency was resilient on the crosses, but failed to gain any strong support and was also finding it difficult to benefit from a deterioration in risk appetite.

There is likely to be greater caution surrounding carry trades, especially with generally downbeat economic data from Australia and New Zealand which should provide an important element of yen protection.

Sterling

Sterling pushed above 1.60 against the dollar during Wednesday in a continuing correction from lows near 1.5850, but the currency was unable to sustain the gains and was then subjected to renewed selling pressure.

The PMI index for the services sector was significantly weaker than expected with a decline to 54.5 for January from 56.8 previously. Although still above the 50 threshold, the data will reinforce fears over underlying vulnerability as credit conditions remain tight. With risk appetite generally weaker, Sterling dipped to lows below 1.59 against the US dollar.

The Bank of England will be the key focus on Thursday and Sterling is likely to decline sharply if there is any move to expand quantitative easing. The MPC is more likely to decide on suspending the programme for now which could provide some degree of support for Sterling, although a key feature is liable to be increased volatility.

There will also continue to be fears over the underlying UK debt situation, especially with political uncertainty still an important factor undermining confidence.

Swiss franc

The dollar dipped to lows just below 1.05 against the Swiss franc on Wednesday before finding support. As the US currency was able to secure a general recovery, the Swiss franc retreated to near 1.06. The Euro was unable to sustain any advance and retreated to towards 1.47 during the day.

The Swiss franc continued to benefit from fears surrounding the Euro-zone and there was evidence of defensive capital inflows.

If the Euro retreats back to below the 1.47 level, there will be renewed speculation over National Bank intervention to curb franc gains.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

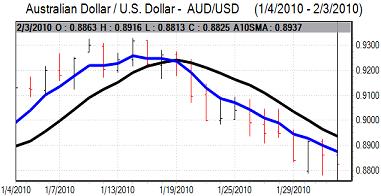

The Australian dollar strengthened to a high near 0.89 against the US dollar on Wednesday, but was unable to sustain the gains. The domestic data was mixed as a rise in building approvals was offset by a decline in retail sales.

Underlying confidence towards the economy has weakened and there are important fears surrounding the international economy which is undermining confidence in the Australian dollar. As these fears persisted, the currency retreated to re-test support levels below 0.88 against the US dollar.