“We just had the awful realization that we were sitting on top of a billion dollar ice cube that’s melting.” – Michael Saylor, CEO – Microstrategy (MSTR)

Over the past year we have written extensively about bitcoin (BTC) as an alternative asset class. You can read our articles here, here, here and here. It’s always important as a trader to understand the 30,000 foot view of the markets and readers should dedicate time to understanding the new world of finance which bitcoin is ushering in.

Last summer, Michael Saylor recognized his company had a giant problem. He was sitting with a billion dollars worth of cash on his balance sheet and inflation was projected to steal a minimum of $20 million per year. Saylor decided the best way to protect shareholders from the debasement of the company’s U.S. dollar cash was to swap it for bitcoin.

His company, Microstrategy was trading at $122 at the time. Saylor spent months studying bitcoin along with the legal implications of putting this alternative asset class on his balance sheet to replace the dollar. Since then, he’s plugged $1.1 billion of the company’s balance sheet into bitcoin.

If MicroStrategy liquidated its bitcoin reserves back into dollars now, it would get $3.45 billion. That’s an unrealized profit of $2.35 billion… or approximately 39x the company’s 2020 operating profits. The stock which was trading at $122 in August has traded as high as $1315 and as I write these words is trading at slightly over $1,000. This represents a 719% gain in the stock in 6 months.

The reason this is noteworthy and critical to understand is that Michael Saylor recently open-sourced his playbook for corporations to learn how to place Bitcoin on their balance sheets. His event occurred February 3-5, 2021 and had 20,000 people register from over 1,000 different corporations. You can watch the recordings of the event here.

How do you buy? Where do you buy? When do you buy? How do you maintain custody of your bitcoin? Should you dollar-cost-average? Or should you buy all at once? What are the tax and regulatory implications? What are the security implications? How do you incorporate Bitcoin into your accounting practices? These are the questions that Michael Saylor answered throughout his three day conference to over 1000 Treasury departments worldwide.

Here are key highlights from Saylor’s opening keynote:

- “There’s a macroeconomic wind blowing – big – it’s gonna impact $400 trillion of capital. That capital is sitting in fiat instruments that are being debased. That capital is going to want to convert into strong money.”

- “Every company has to make one of two choices. You either have to decapitalize, which is kind of like self destruct… or you have to recapitalize with an asset which is going to appreciate faster than the rate of monetary supply expansion. This is where bitcoin comes in.”

MicroStrategy is only the first of a much wider adoption trend that will eventually see governments and central banks move into bitcoin.

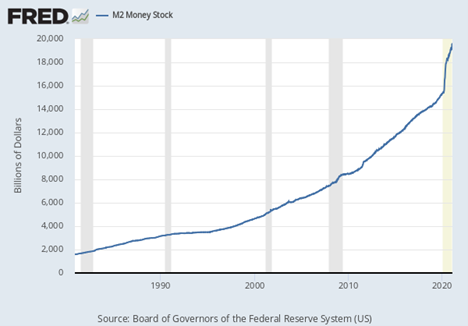

Once the new administration in the US government finalizes the next $1.9 trillion stimulus package, they will have increased the US dollar supply by 40% in the last 12 months.

Think about that for a minute.

There will be 40% more dollars floating around the economy.

Are you going to make 40% more this year than last year? Is your company growing revenues by more than 40% per year? If not, you are being debased. End of story.

This startling fact is completely ignored by most people in the mainstream dialogue. The focus has been on mitigating short term pain for individuals, small businesses, and investors. But we can’t make decisions that completely ignore the reality of long-term destruction.

It shouldn’t be a surprise to anyone that two days ago, electric carmaker Tesla (TSLA) announced a $1.5 billion bitcoin purchase. The company plans to use bitcoin as a cash reserve asset and also accept it as payment. Two weeks earlier, Elon Musk, the CEO of Tesla, has changed his bio on Twitter to one word – #Bitcoin. Then he posted some favorable comments about bitcoin which has led Bitcoin to explode to new all-time highs.

Tesla is a Fortune 500 company. There is zero chance they are buying Bitcoin if there was any regulatory concern that it would jeopardize the rest of their business. Second, the Tesla purchase removes any career risk/uncertainty for other Treasuries and CFOs who are contemplating a similar decision.

Tesla’s $1.5 billion purchase is approximately 15% of their net cash position.

In Spring 2020 Paul Tudor Jones and Stanley Druckenmiller announced to hedge funds that they were moving into bitcoin which made Wall Street investors comfortable, Elon Musk and this recent purchase by Tesla of $1.5 billion will make corporations comfortable.

Why is this important? Companies are figuring out what works best to store value. And they’re choosing bitcoin.

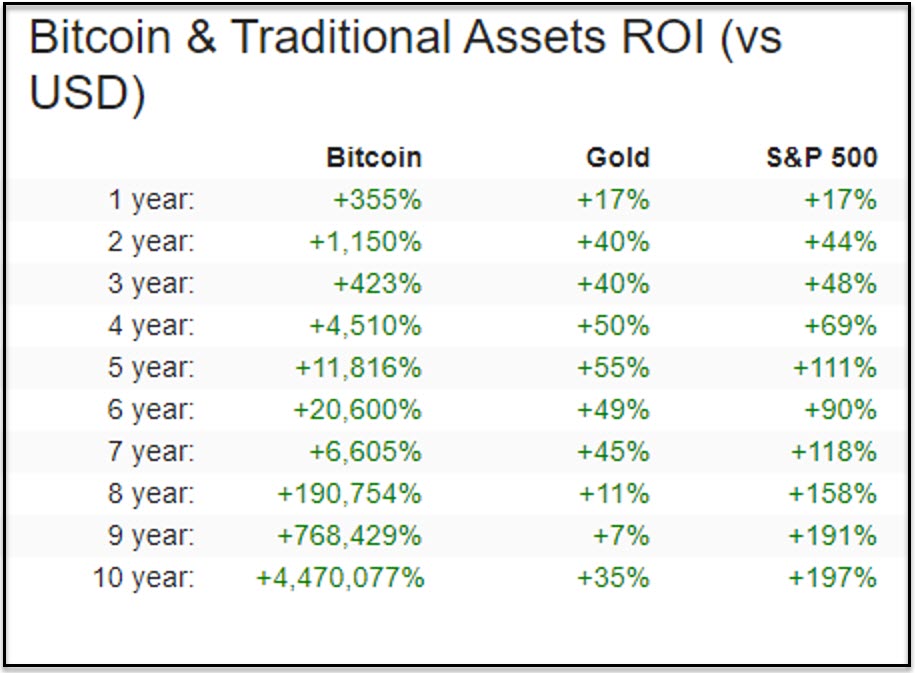

The numbers tell the entire story.

Here’s why…bitcoin has an unalterable protocol at which new bitcoins enter into the economy. This rate decreases over time.

Currently only 900 new bitcoins are created daily.

On December 12, 2021 will mark the date when 90% of all bitcoin will have been mined. The remaining 10% will take over 119 more years to come into existence.

Other cryptocurrencies have key players, owners, insiders, and development teams that can potentially act like central banks. They can boost supply, or change the rules, if they choose to. This is a powerful temptation that humans have never been able to resist.

Bitcoin takes human intervention out of the equation. Nobody alters its supply or change the rules. They’re fixed for eternity. No other asset – not even gold – comes near bitcoin’s inflation-resistant properties.

Central Banks Will Be Forced To Jump In NEXT!

Currently there are 38 public companies that have put bitcoin on their balance sheets as a reserve asset. This number will grow exponentially over the coming few months. Keep in mind that TESLA is now part of the S&P 500 Index. When Elon Musk moved into bitcoin, he signaled to all major publicly traded companies that they should also start converting their balance sheets to bitcoin.

Imagine for a moment that you are in the board room of any of the following companies as they discuss what they are going to do with the cash on their balance sheets.

Apple has $208 billion dollars in cash on their balance sheet.

Microsoft has $136 billion in cash on their balance sheet.

Facebook has $20 billion in cash on their balance sheet.

Google has $117 billion in cash on their balance sheet.

Amazon has $49 billion in cash on its balance sheet.

Netflix has $5 billion in cash on its balance sheet.

Nvidia has $10 billion in cash on its balance sheet.

How would you advise them based upon negative interest rate consequences?

If these 7 companies mimicked what Jack Dorsey did last week and invested 1% of their balance sheet cash into bitcoin that would amount to over $5 billion. What about the remaining 493 stocks in the S&P 500? Or the remaining 8000 stocks that trade on the other remaining exchanges?

What comes next?

Will we see central banks and governments eventually move into bitcoin as well?

The countries most likely to embrace bitcoin are the ones with the least to lose initially.

Iran, Venezuela, Pakistan and Kazakhstan are among the leading candidates who are getting involved in bitcoin mining.

Are corporations and governments about to launch bitcoin to a whole other level?

I wouldn’t be surprised to see bitcoin surpass $100,000 if this occurs.

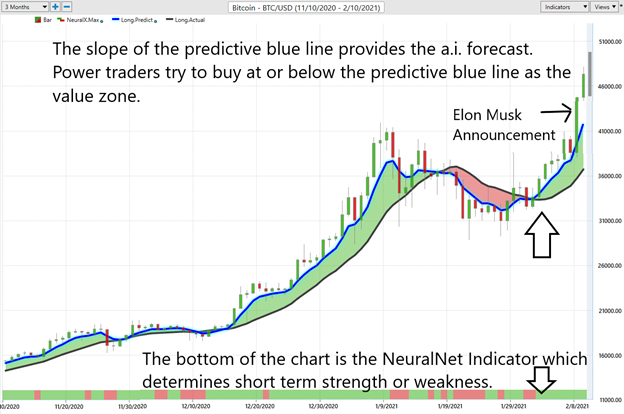

Do your own due diligence. As you do, pay attention to the Vantagepoint A.I. Forecast which has kept traders on the right side of the trend at the right time throughout Bitcoins bull move.

This is where artificial intelligence comes in and why it is so powerful.

A.I., through advanced pattern recognition, analyzing tens of thousands of data points, and crunching millions of computations, finds the highest probability trades and is indispensable in separating fact from fiction.

The power of artificial intelligence is designed to keep you focused on the right side of the market at the right time. Never trading on hope or toxic emotions.

Isaac Newton stated that “a trend in motion, tends to remain in motion until it is stopped.” The risk today is too high for opinions or guesswork.

Remember that ai has defeated humans at Chess, Poker, Go and Jeopardy.

Why should trading be any different?

I invite you to learn how to trade Bitcoin at our Next Live Training.

It’s not magic. It’s machine learning.

Make it count.

IMPORTANT NOTICE!

THERE IS SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.