Gold has staged a breakout, hitting a new record high this week above $1,045 an ounce. I think this run is far from over and there is a convincing argument to be made for further gains in the months ahead.

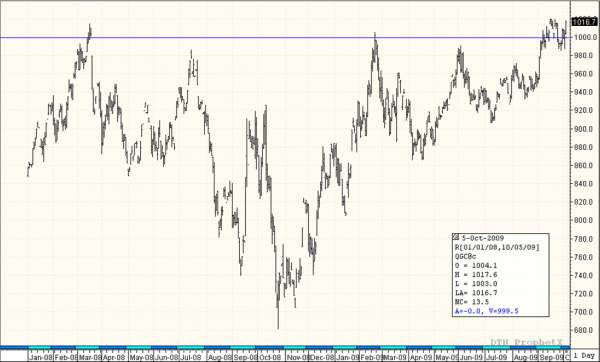

The market had been hovering around $1,000 for about six weeks, and the move on Tuesday, October 7, to new highs was a much-anticipated breakthrough. After hitting a record high in 2008. momentum faded and gold diehards got repeatedly backed into a corner. Gold had spent the past year and a half building momentum and building confidence for a push back above $1,000. This is the fourth time since 2008 that gold has pressed $1,000, and the old record high of $1,033.90 was finally taken out.

Gold, 2008 – Present

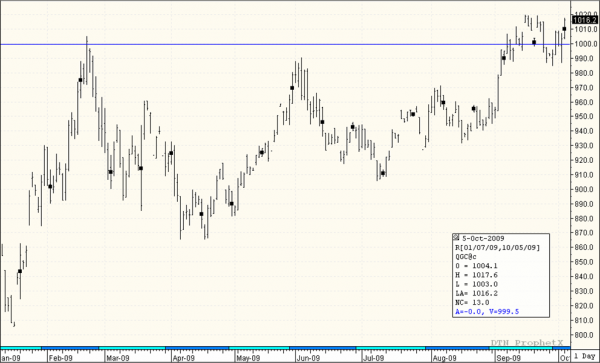

In just the past three months, we’ve seen a unique move relative to what we’d seen in the past for this market. Bullish gold traders had gotten burned after the 2008 peak, but with each successive break this time around, gold was able to maintain a base of support near $1,000 and traders became more confident. Finally, they felt it was time to push the market. As soon as gold broke through resistance at $1,032 this week, it took out another major area of resistance at $1,037.

Once a few days or weeks pass and the market can absorb the move, I think we’ll see this momentum accelerate. We could see some tremendous moves.

Gold, Past Three Months

Inflation Fear Inflating Gold Prices

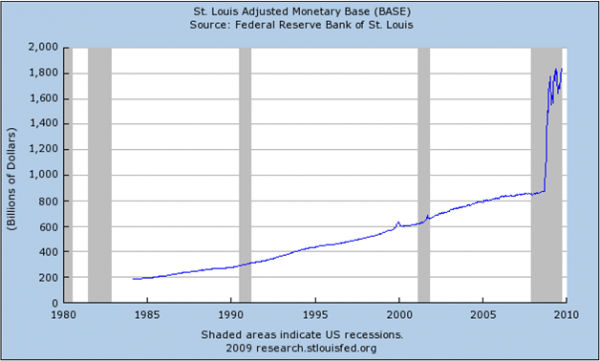

The fundamental side offers a convincing argument for higher gold prices. Countries around the world in the past year and a half have been printing money like crazy, and inflation is a likely result. We often use the U.S. as a discussion point in terms of injecting liquidity into the system, but the U.S. is not alone in that endeavor, so I’m not picking on the U.S. as having these problems alone. We’ve had many times in history a country has printed a tremendous amount of money to get out of financial crisis, and usually that results in hyperinflation. Today, we have many counties doing that at the same time.

Countries around the world, including the Eurozone, U.K., even Australia and Japan, have had global macro problems and have been printing money. When governments do that, investors seek to put capital in something that can’t be inflated. Gold mined 3,000 years ago is still in the system. The amount added each year through mining is miniscule compared with existing supply. So, by definition, you can’t really inflate the supply of gold—just its price. And that’s one of only a few commodities where that’s the case.

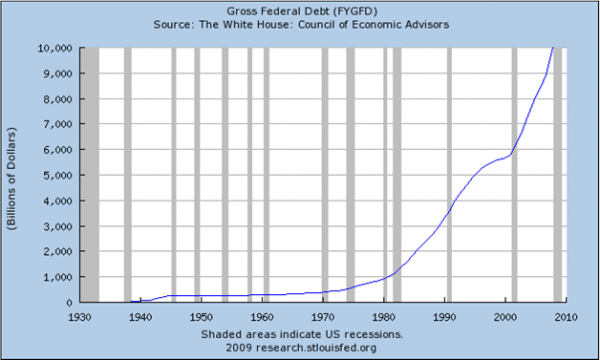

What is clear with the charts below is that the environment is different from other recessions, including the recession of the 1990s or even the tech bubble or tech wreck in 2000 – 2001.

Members of the Baby Boomer generation have been moving toward retirement, and not enough money has been put aside to support them leaving the workforce. Countries have been using social security funds as basically slush funds to support fiscal expenses. So we have a situation where there is no money and a lower population behind the Baby Boomers who can’t support them. At the same time, U.S. Federal debt is climbing, and I could show dozens of charts depicting how personal debt is rising.

One way to fill that gap is to raise taxes, but realistically, governments can only do so much of that before the economy collapses. The government can renege on its promise to provide support. Or, it can print money and inflate other areas of the economy. We are in a phase where life isn’t looking so rosy, and you have to find ways to protect your wealth. That’s driven many investors to gold.

Gold has been one of the few commodities that hasn’t suffered during the financial crisis and global recession of the past year and a half. It’s held up pretty well, and investors are responding to the fears I’ve just described.

Strategies for Gold Bulls

For those reasons, I think the case for gold remains bullish. The simplest way to capitalize on further gains in gold is to simply buy a gold futures contract and hold it. There are other strategies, of course. You can sell put options if you are someone who believes in the long-term gold story, but aren’t that keen on buying at these record levels. Pick a level where you would feel comfortable, say $1,000 or $900. While this strategy carries unique risks and is not right for all investors, selling a put option means you can collect a premium. If you sell a February $1,000 put option, for example, you’d collect about $37 an ounce for selling the right to sell gold at that level. If gold keeps moving up, you’ve still got that $37 per ounce in your pocket ($3,700 per contract), and can use that capital for another strategy. If gold drops to $1,000 come February, you’ll then get to own gold at $1,000.

There are many combinations of options you can use, and you have to decide which strike prices you want. You can also consider a bull call spread, if you think the market will make a dramatic move but desire more defined risk. This strategy places limits on the amount of risk you are taking on, as well as the amount of profit you could potentially make.

Call options tend to be expensive, because everyone is eager to end up in a situation where they have the right but not obligation to own the commodity. So you would sell a more expensive call option to pay for the other you are buying at a different strike price. For example, you could buy a $1,050 call and sell a $1,100 call. The premium collected from selling the $1,100 call will offset some of the price you pay for the $1,050 call. As of Tuesday, October 6, the $1,050 call would cost about $54 and you’d collect $38 from selling the $1,100 call. That’s a net cost of about $16 an ounce to buy that spread (subject to change). That’s your defined risk. If, at the end of January, gold moves above $1,100, you’d have a gain of $34 per ounce. That’s a 2-1 risk-return profile.

The margin requirements on options can be complex. The margin process for process uses something called SPAN margin, which calculates how much risk is involved in the position taking various factors into account. A rule of thumb, however, is that margin is likely to be less on what’s considered to be a less-risky options position than an outright futures position. Margin for a COMEX gold futures contract currently is $4,500, while margin for the smaller E-mini gold futures contract is $1,485. Keep in mind margins are subject to change at any time without notice.

Price Outlook

Obviously, making long-term projections on the price of any market is a challenge, especially when you dealing with a market like gold, which can be very volatile. However, I feel comfortable suggesting that between now and Christmas, gold could see $1,200, and maybe beyond that level into the first-quarter 2010. What I’ve seen in the past when a market has made moves like this is that traders tend to panic, feeling they missed the run. It’s like trying to catch the last bus of the day leaving town. So I think we’ll see gold really wake up, and we could see some big moves ahead in this market. We’ll probably even see some investors become absolutely obsessed with gold. In 2008 when gold was surging to record levels, a lot of gold traders were pyramiding into positions, plowing their gains back into the market as collateral for new trades. A lot of those types of traders got hurt in 2008 when the market corrected, and it’s taken a long time for those traders to get comfortable again, and rebuild their capital. I think it’s a different economy now, and now we are in new territory. We’ll see more talk about gold in the news, and new participants who hadn’t traded in the past are likely to pour new capital. The rally will feed on itself.

If you would like more details on specific trading strategy, or have any other questions about the futures markets in general, please feel free to contact me.

Aaron Fennell is a Senior Market Strategist and Chartered Financial Analyst based in Toronto with Lind-Waldock, a division of MF Global Canada Co. He is accepting clients from Canada and can be reached at either 877-840-5333 or 416-369-7933, or via email at afennell@lind-waldock.com.

The data and comments provided above are for information purposes only and must not be construed as an indication or guarantee of any kind of what the future performance of the concerned markets will be. While the information in this publication cannot be guaranteed, it was obtained from sources believed to be reliable. Futures and Forex trading involves a substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Please carefully consider your financial condition prior to making any investments. Not to be construed as solicitation.

©2009 MF Global Ltd. Lind-Waldock, a division of MF Global Canada Co. Toll-free 877-501-5463. MF Global Canada Co. is a member of the Canadian Investor Protection Fund.

Futures Brokers, Commodity Brokers and Online Futures Trading.

123 Front St. West, Suite 1601, Toronto, Ontario M5J 2M2