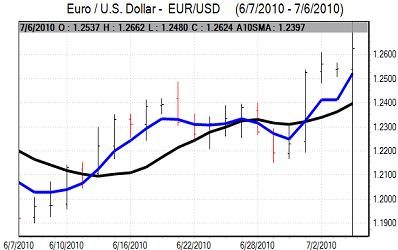

EUR/USD

The Euro found support below 1.25 against the dollar in early Europe on Tuesday and then strengthened steadily during the day. Equity markets looked to rally after recent losses and this helped improve risk appetite which also helped underpin the Euro.

There was some stabilisation in sentiment surrounding the Euro-zone bond markets which also helped bolster Euro sentiment with some optimism that budget deficits could be brought under control without triggering a renewed recession. Sentiment could still reverse rapidly given the underlying structural vulnerability and the Euro has still been dependant on a reduction in short positions.

The US ISM index for the services sector dipped to a weaker than expected 53.8 for June from 55.4 the previous month. Most components were lower over the month and the employment component dipped to just below the 50 level. The data will reinforce expectations that the economy is slowing and there will also be a further scaling back of expectations surrounding any increase in interest rates by the Federal Reserve.

The dollar was hampered by the decline in yield support and defensive demand for the US currency also failed to appear as stock-markets remained higher. In this environment, the dollar weakened to lows around 1.2660 before a tentative recovery to 1.2620.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The latest data recorded strong buying of Japanese bonds by China during the first four months of the year which provided some underlying support for the yen. The latest Japanese economic data did not have a significant impact with a small decline in leading indicators.

Global economic developments still tended to dominate and there was an underlying mood of caution with expectations of a further deceleration in growth. The Nikkei index dipped to a 7-month low before a limited recovery which helped maintain the mood of caution. The dollar edged lower to test support below the 87.60 area against the yen during the Asian session as yield support remained weaker.

The dollar weakened again following the US data with lows around 87.35 before consolidation just below 87.50. The yen proved resilient in the face of rising equity prices which suggests that underlying demand for the currency has increased.

Sterling

Sterling hit resistance close to 1.52 against the US dollar in early Europe on Tuesday and found it difficult to secure any momentum during the day.

There was no UK economic data to guide markets and there was a growing feeling of unease over the risks of a significant second-half economic slowdown.

The Bank of England MPC meeting starts on Wednesday with a decision due on Thursday and there will be reduced expectations of a move towards higher interest rates even if Sentance again votes for an increase.

Sterling pushed to 1.5220 resistance following the US data, but it failed to hold the gains and it retreated to 1.5150 later in New York trade. The UK currency also weakened to two-week lows around 0.8340 against the Euro with Sterling unable to gain support from an improvement in international risk appetite.

Swiss franc

The dollar was unable to push above 1.0680 against the Swiss franc on Tuesday and weakened to lows near 1.0560 in US trading before settling near 1.06. The Euro was able to secure a net advance against the franc and settled close to 1.3370.

Swiss consumer prices fell a larger than expected 0.4% for June to give a 0.5% annual increase which was lower than expected and there will be renewed speculation that the National Bank will decide to resume intervention to weaken the Swiss currency to combat deflationary pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

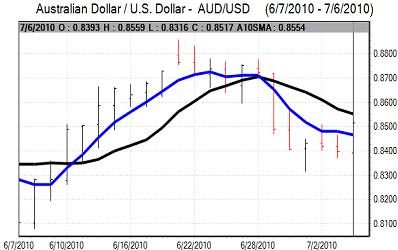

Australian dollar

The Australian dollar came under pressure in early Asia trading on Tuesday with lows close to 0.8310 against the US dollar before finding firm support. The Reserve Bank of Australia left interest rates on hold at 4.5% following the latest meeting. The statement was slightly stronger than expected with the bank still warning over inflation risks, although it also expects growth to moderate.

Reduced expectations of a near-term rate cut supported the currency and it rose to a peak just above 0.8550 in New York trading as the US currency also came under pressure. There are still very important risks to the global economy and the Australian currency will be at risk of renewed selling pressure. The currency retreated back to 0.85 against the US dollar later in the US session.