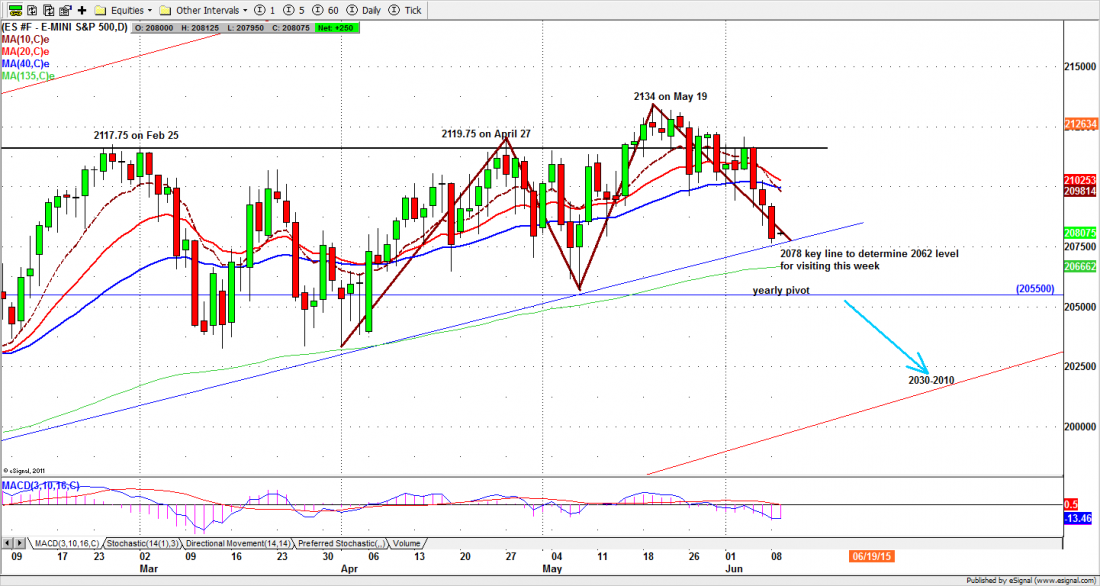

The S&P 500 mini futures (ES) opened low on Monday and continued lower. The futures spent the entire session in the red, made a low at 2076 – just above the support level at 2075 – and closed at 2079.25 for a loss of about 13 points. In fact the entire US equity market – DOW, SP 500 and NASDAQ — all ended with losses yesterday. The large caps are now down almost 60 points from the all-time high set May 19.

The June futures contract is drawing closer to the cash index as we move toward the contract expiration next week. By Friday traders will be using the next nearest contract (September) and we will see some additional volatility in the market as the price adjusts to the new contract (ESU5).

Today

We may see a brief bounce today (Tuesday) if the price stays above 2075 in overnight trading. But 2098-2102 is the current major resistance zone. As long as ES stays below that level, the short-term trend remains down, and we could see the futures move to retest 2078-75 today, or move lower to challenge 2066-62.50.

Major support levels for Tuesday: 2076.50-78.50, 2062-59.50;

Major resistance levels: 2106-07, 2123.50-2121.75, 2134-36.60

To receive free market insights with actionable strategies from naturus.com, click here

Chart:

ESM5 Daily chart, June 8, 2015