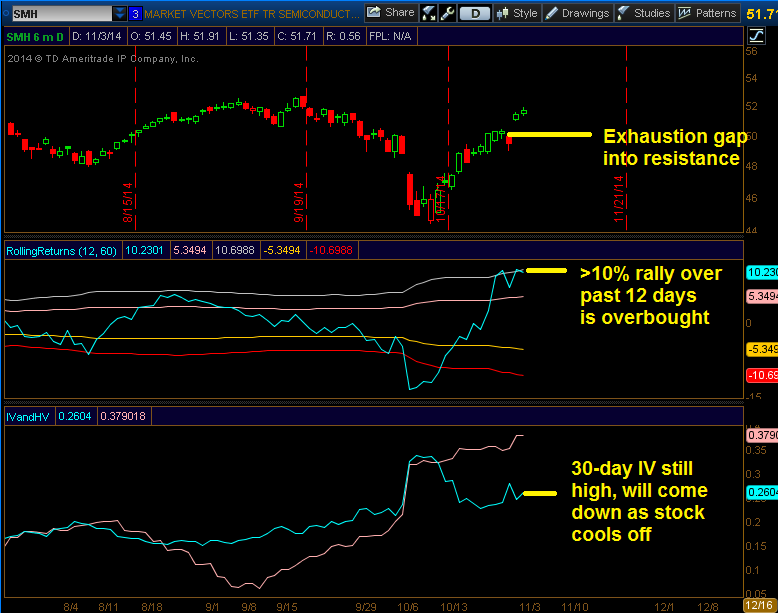

The ETF, SMH (semiconductor index) is at a good level for a contrarian short play. After an ugly correction in October on the back of Microchip Technology’s (MCHP) guidance, investors learned quickly that the semiconductor sector fundamentals weren’t that bad as earnings continued to come out. A rally began and those who felt left behind are now chasing the sector higher.

But the sector is coming to a point in which it makes sense for a countertrend short trade. There is a clear level of resistance at 52.50, and Friday saw what I would consider an exhaustion gap higher on the back of Bank of Japan news.

Choosing the right option trade is important, and, in this kind of situation, buying puts straight up is not the best bet.

During this entire rally, implied volatility has stayed high in the mid-20s, compared to the 15%-20%range it was in from June to September. The probable reason is a lack of option sellers, rather than large put buyers.

Most likely, as the market pulls back, more investors will be interested and start to sell puts or dump hedges to re-expose them to this market.

As an alternative to straight up puts, buying a put spread makes sense.

- Buy to open SMH Dec 50/46 put spread for 0.75

This trade works because it is vega neutral, meaning, if implied volatility falls it won’t lose value (unlike long puts) and it also takes advantage of an advanced options concept – a high “skew.”

A put spread makes more sense if you expect SMH to sell off but not crash, and you want to avoid any risk with respect to implied volatility.