Central banks have played a remarkable role in the last seven years.

In fact, since the beginning of the biggest financial crises in the world, August 2007, financial markets have been substantially helped by the exogenous intervention of both the European Central Bank (ECB) and the Federal Reserve.

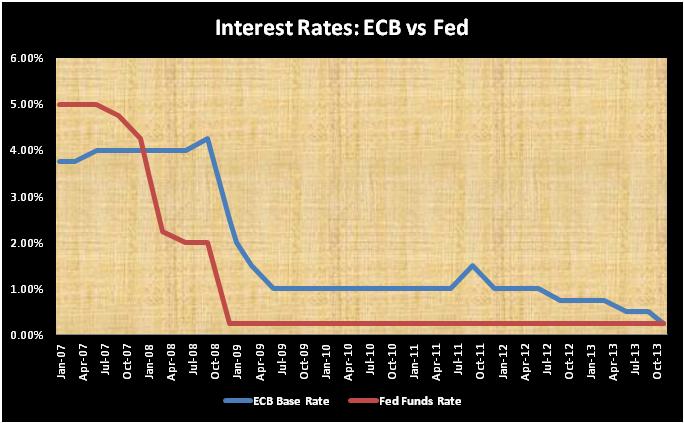

However, the aforementioned central banks haven’t just injected money into the system and bought toxic assets in order to restore confidence among market players — they have done more than that. They have also reduced the cost of money. In other words, they decreased interest rates. Figure 1 plots the fluctuations of the base and funds rates governed by the ECB and the Fed respectively.

Figure 1 displays the oscillations of the above mentioned rates since January 2007 so far. Clearly, the healthy financial conditions at the beginning of the 2007 allowed both central banks to keep interest rates at a fairly high level (4% for the ECB and 5% for the Fed) but as soon as the economic environment started to deteriorate they have been forced to quickly change their monetary policies to face the enormous losses provoked by the credit crunch.

The Fed began lowering the funds rate in July 2007 and, in a matter of two years, brought it to 0.25% while the European Central bank moved more slowly and it started to cut its rate only in October 2008 (almost one year later). The ECB has been keeping the base rate higher than the Fed funds rate since January 2008 but it decided to cut it down to 0.25% a few days ago (November 2013).

The ECB moved less quickly than the Fed probably because of the political pressures coming from all the countries within the Euro–zone and the national divisions among all its members. Nevertheless, we can definitely be sure that both central banks governed by Trichet (substituted by Mario Draghi in November 2011) and Bernanke (substituted by Janet Yellen in early 2014)) have been following similar steps.

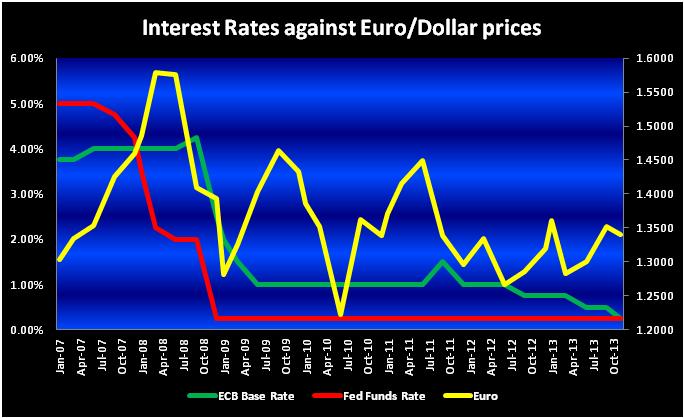

In fact, the overall correlation between the ECB base rate and the Fed funds rate is as big as +0.87. Did their combined monetary policies have any influence on the Euro–Dollar exchange? The next chart shows the fluctuations of both rates along with Euro futures prices and it will help us understand how big the impact of interest rates changes was on the Euro/Dollar market.

Figure 2 displays the performance of the Single currency (yellow curve) since January 2007 so far. The graph shows that in the period April 2008 – October 2008 the Euro was plummeting and so were the ECB and Fed rates. The Federal Reserve did not increase its funds rate since December 2008 but since that date the Euro has never managed to keep above the 1.4500 threshold for more than a quarter. Furthermore, the shy attempt to increase the ECB base rate in September 2011 failed two months later and since January 2012 the Euro never managed to successfully violate the 1.3650 barrier and 1.3500 now marks the beginning of solid resistance area. Needless to say that rate manipulations operated by the European Central bank, although closely linked to those performed by the Federal Reserve, have a higher correlation with Euro prices (+0.50) and consequently should be monitored with greater attention.

Conclusions

- The European base rate and the American funds rate dropped dramatically over the last six to seven years.

- The monetary policies adopted by the ECB and the Fed have followed a similar path although the timing of the implementation differs.

- The correlation between the ECB base rate and the Fed funds rate is as high as +0.87.

- The ECB monetary policies influenced, for obvious reasons, the fluctuations of the Single currency in a more direct way than the Fed’s ones.

- When the ECB base rate was as low as 1%, the area around 1.4500 became a robust resistance level for Euro futures.

- Since the ECB base rate dropped to 0.75%, the 1.3500 – 1.3600 interval became the new resistance level to break.

RELATED READING

Read another story by this author: S&P Correlations To Key Economic Data