There is quite the buzz, a true “hullabaloo”, if you will, over 3D Systems Corp. (DDD).

News, investors, speculators are really creating a frenzy over 3D printing. It’s even on talk radio that I listen to from time to time in the mornings. Truthfully, I can get on two bandwagons.

TWO ANGLES

The first bandwagon I can ride regards the benefits of 3D printing. Science is taking this as far as creating human tissue from 3D printing. So, instead of someone waiting on an organ donation, ‘how about we walk over here to the printer, press print and…a new liver, you’re welcome.’

Other news stories I’ve heard were successful printing of food, clothing and various sorts of resources. Sounds very “Star-Trek” I know, but that kind of mystery and potential growth in a specific sector is what keeps hedge fund managers up at night.

The other bandwagon that exists out there is the potential abysmal and utter failure of 3D printing because of copyright infringement, illegal actives and the simple fact of how expensive the printers would be for normal consumers. The purchase of these machines could eliminate the overall infrastructure of commercialism and the American economy, blah blah, you know, the whole dooms day theory out there. I’m not specifically on the “world ending band wagon” but I can see the potential detriments of this product to the retail business if a 3D printer truly can create anything we want it to.

MARKET PLAY

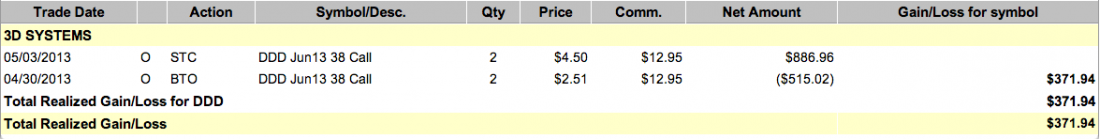

Regardless of the above theories and controversy, I am a professional options trader. DDD is a stock which is option-able. DDD has a lot of volatility and good overall volume. This was a previous trade I placed. However, I still feel the opportunities are abundant on this stock.

The blue line is the 100-period simple moving average. The red line is the 200-period simple moving average. I’ve created a retracement Fibonacci range as well. I initially entered this trade bullish on 4/30/2011 buying May calls. Below is some of the information:

BULLISH RETURN

Nothing huge on the trade but I was happy with the 50% return. There are a couple of current plays on DDD, now that it has broken out of the long term moving averages, with good volume and nice size candles. DDD would be a good long opportunity if the stock pulls back to the .382 retracement (around 39.10) which also coincides with the 10-period exponential moving average. At that point, a stop could simply be placed under the 50-period exponential moving average and let’s watch DDD ride the momentum.

OPTION TRADE

If an investor has the specific plan, capital and strategy in place to buy shares of DDD, one could sell to open the June 36 put. As I write this, a minimum of 1.25 per contract could be made on this trade. 10 contracts would be $1,250 minus commission. That is premium to keep if DDD stays over $36 by the third Friday in June. DDD would theoretically have to drop to $34.75 before you would have any real risk of getting put the stock.

However, if that’s an investor’s goal in the first place it is not a bad way to leg into this trade. DDD has high implied volatility on its’ puts as well, a benefit if you’re selling options. Keep your eyes on this stock as it will continue to make headlines!