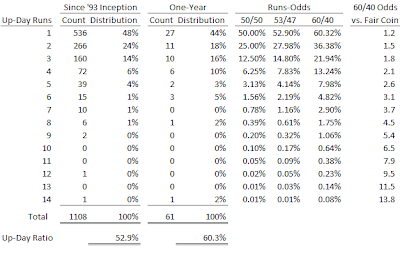

It’s more of a mathematical curiosity than anything else, but check out the odds of 14 successive up-days below, the record for which looks to get set by the SPY today. If that’s not a pot of leprechaun gold for the bulls on this St. Pat’s day, I don’t know what is!

But what really stood out to me in this quick study, was the dramatic bullish bias shown this last year with over 60% of days ending higher as compared to 53% since the SPY’s inception seventeen years ago in 1993.

This strong bullish bias significantly increases the odds of successive runs over a “fair” 50/50 flip of the coin. However, what are the independent odds of another up-day tomorrow? This is the “Gambler’s Fallacy” — it’s just like day one all over again. Well, coins don’t have any memory, do traders?

Notes: Observations are non-overlapping. For the curious, the previous record of 12 days, set in 1995, was followed by two mild down-days with new highs ensuing within five, and then a fairly range-bound trade for about a month-and-a-half before the market continued its ramp higher. Also see – July Flashbacks.