Over the past month a rebellion has manifested itself in GAMESTOP (GME). This event and stock is emblematic of the monetary times in which we live. GameStop represents a host of issues that have been boiling since the 2008 Financial Crisis. Like every good story there is a ton of drama, heroes, villains, criminality and hearsay. But unless you define the backdrop of this canvas very carefully it can get confusing very quickly.

One of the most successful archetypal stories of all time is the tale of an underdog who, in spite of massive odds against them, takes on a much more skilled opponent and vanquishes them.

GameStop is exactly this type of tale.

GameStop is a video game store with over 5,000 outlets where customers can buy, sell, and trade their games, consoles, and gaming accessories. In 2020 they actually lost over 750 million dollars. They had closed 783 stores throughout the country over the previous 24 months. Over the past few years this business model has struggled as gaming has been disrupted by digital delivery platforms that are making GameStop as a shopping center staple almost obsolete. Analysts who study the fundamental business factors of GameStop place a fundamental value on each share of GameStop at roughly $11.93 a share. Many analysts feel that GameStop is quickly becoming obsolete as customers are purchasing their video games and equipment online.

Let’s start with the psychology. There is a deep distrust in society for the hedge funds and banks who constantly profit at the expense of the little guy. The mood in the marketplace is that the big guys have gotten bailed out repeatedly for horrible business practices. Whether it was the 2008 housing crisis, or naked short selling the mood on the street is that the larger players are front running trades, have access to lower cost of capital and receive preferred treatment by regulators. This has created a mood where the little guy feels that they are at a huge disadvantage in a system that is rigged against them.

This feeling has been amplified by the Federal Reserve and our elected officials. They continue to intervene in markets via quantitative easing distorted price signals. The dollar is being devalued at an incredible rate, but nobody dares to care about that. This punishes the 45% of Americans who live paycheck to paycheck and have no investable assets. They feel that regardless what they do, that they can’t get ahead. Everything is getting more expensive, but they’re not making more money.

This is exactly what is happening. The bureaucrats establishing monetary and fiscal policy have built an economic environment that rewards investors, punishes savers. This massive market manipulation of the past year, and specifically the last thirteen years since the 2008 Financial crisis inflates financial asset prices and devalues savings.

You literally have tens of millions of people who are scarred by the manipulations of the past.

But then the internet accelerates the dissemination of information by democratizing everything. Today you have commission free trading, financial information is readily available to the smallest of traders and it is almost frictionless to buy fractional share purchases at close to zero cost. In other words, you don’t need a seat on the Big Board and Wall Street connection to play the game successfully.

This mood has been building in the markets for over a decade. You might remember that in April 2020, Warren Buffet exited all of his airline stocks at huge losses when the economic lockdown was announced. Buiffet’s parting comments were, “I wish the airlines well.” Literally within 30 days the price of the airline stocks doubled in price as small investors, aggressively purchased the airlines almost relishing Buffet’s dismal performance.

But then a truly unexpected thing happened recently. The small trader, through an online Reddit community called WallStreetBets noticed that the largest hedge funds had shorted 140% of the float on GameStop stock and the regulators were asleep at the wheel. Shorting a stock is when you borrow the asset first in the hopes that it will decline in price, allowing you to buy it back later. How do you short 140% of the float? Well, the brokerage companies just loan out stock that they don’t have to create a return on their balance sheet out of thin air. This practice is illegal and unethical. It was responsible for the 1929 Stock Market Crash and numerous regulations have been passed prohibiting this form of Naked Short selling.

WallStreetBets theorized that since the regulators, brokerage companies, and hedge funds were colluding, that if they organized their 2 million followers and started purchasing GameStop the prices would rise and the short sellers would be forced to cover their shorts at higher prices creating what is known as a short squeeze.

This is exactly what unfolded. An online community of investors and traders who started trading with their stimulus checks last spring, banded together and recognized that the hedge funds were massively vulnerable due to their unethical business practices. These individuals as retail traders had been labeled the “dumb money” for years by Wall Street now had the upper hand. The strategy was brilliantly simple. Within two days, GameStop was the most heavily traded stock in the world. WallStreetBets users were posting screenshots of their suddenly inflated account balances.

GameStop was trading around $17.90 a share on the first trading day of the year. It traded as high as $486 a share less than 4 weeks later. That’s more than a 26x return in a period of a few weeks. This has nothing to do with fundamentals, technical analysis, or the underlying assets of GameStop. It’s the execution of a short squeeze by the retail trader against Wall Street Hedge funds.

The strategy was brilliantly simple. GameStop was the most heavily traded stock in the world. WallStreetBets users were posting screenshots of their suddenly inflated account balances. It quickly became clear that the hedge funds were on the wrong side of the trade and that the price would have to spike higher.

Many of these smaller Reddit traders purchased deep out of the money call options on GameStop. Whenever a market maker creates a call option on a stock, they hedge this position by purchasing a very small amount of the underlying asset to limit their risk exposure. This fact in and of itself is one of the reasons that GameStop accelerated so quickly in this recent rally. Market makers were forced to continue having to purchase the underlying stock as GameStop advanced in price.

“It’s time for a government bailout of GME shareholders at $10,000 per share. This would be roughly equivalent to the $700 billion bank bailout in 08 that was necessary to prevent ‘systemic risk’.” – WSB user ‘TheHappyHawaiian’

This tug of war will continue to unfold over the coming weeks it is far from over. What is hugely educational to observe and make note of is what the reactions have been from regulators, politicians, investment media and the trading community.

As the GameStop stock spiked CNBC criticized the small trader for recklessly manipulating the market. Melvin Capital, a hedge fund that took a massive short position in GameStop, lost 30% of its funds just this month. The damage was so bad that two other famous hedge funds, Citadel and Point72, had to step up with $2.75 billion in capital to save Melvin Capital from collapsing. To make the unfolding drama even more interesting, Ben Bernanke, the former Federal Reserve Chairman sits on the board for Citadel.

The WallStreetBets platform on Reddit was disabled. The justification provided was that the users were engaged in hate speech and spreading misinformation. The RobinHood App and trading platform prevented users from further purchased the stock. These platforms are using very opinionated double standards to pick and choose which individuals or groups they want to ban, censor, and ultimately “cancel.” The Securities and Exchange Commission (SEC) even had to step in to say:

“We are aware of and actively monitoring the ongoing market volatility in the options and equities markets and, consistent with our mission to protect investors and maintain fair, orderly, and efficient markets, we are working with our fellow regulators to assess the situation and review the activities of regulated entities, financial intermediaries, and other market participants.”

Truly amazing. Hedge funds position themselves 140% short illegally and this is the regulators response?

There is nothing wrong with discussing investment ideas and buying a stock with the potential for a short squeeze. Banning or censoring opinions about stocks on the basis of misinformation? Wow!

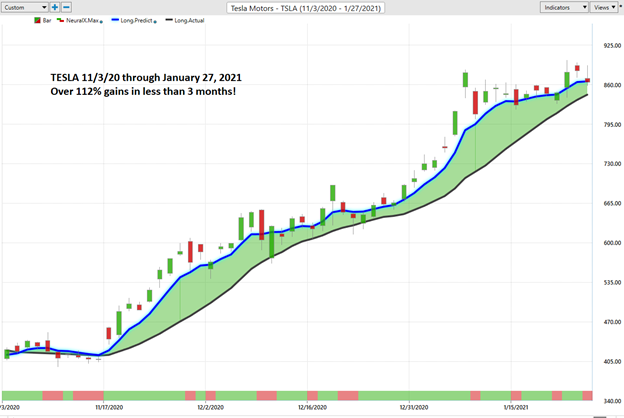

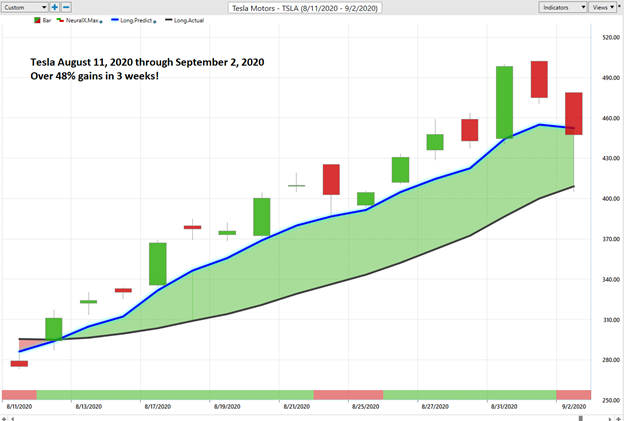

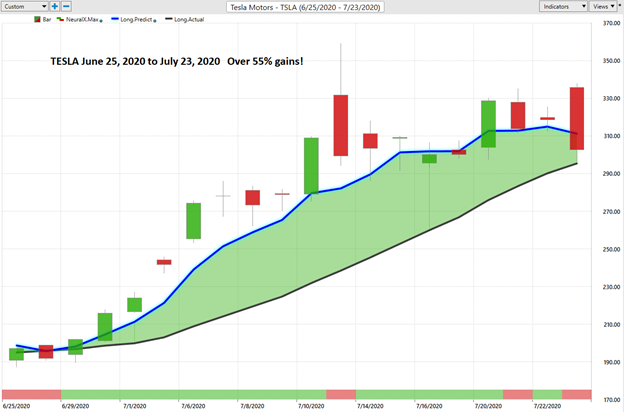

One of the hardest things traders need to do is disconnect the noise of the media from the reality of price action. For the last several years, Wall Street and the media hated companies like Tesla because they were upsetting the status quo. Several traders who follow our a.i. have told us repeatedly how wrong our analysis was. Of course, there were many experts and hedge funds on Wall Street shorting the stock.

Look at the following charts and decide for yourself.

Was our analysis misinformation? Should it be banned because the Wall Street Elite and others disagreed with it?

Just because an opinion is different from the prevailing ideas does not mean that it should be censored or banned. It also does not mean that it is misinformation.

The dangerous thing that has occurred in GameStop is not the volatility or uncertainty. Yet, this is precisely what William Gavin the Secretary of the Commonwealth of Massachusetts is calling for. Gavin is seeking to pass regulation that there should be a 30 day trading suspension on GameStop to protect “small and unsophisticated” investors. Many other politicians are doing likewise.

Gavin’s suggestion would have serious consequences for traders everywhere.

First, consider the parameters and definitions required to constructing such a regulation.

When exactly does a rally become unacceptable or dangerous? 5%? 10%? 2%?

Would strong rallies be considered illegal?

Would they even be permissible?

Are we seriously contemplating the idea that price movement is a crime?

In December, GameStop recently appointed three new directors in an attempt to turn the company around. Is this the precursor to market manipulation?

This suspension proposal would put every rally at risk of potential closure––halting the growth of companies and industries, alike and cementing their fate into the hands of bureaucrats who deem to know better than the free market.

Rallies are a normal and essential part of financial market activity. At its core, price discovery involves finding where supply and demand meet.

The key difference here is that it was that David pulled one over on Goliath.

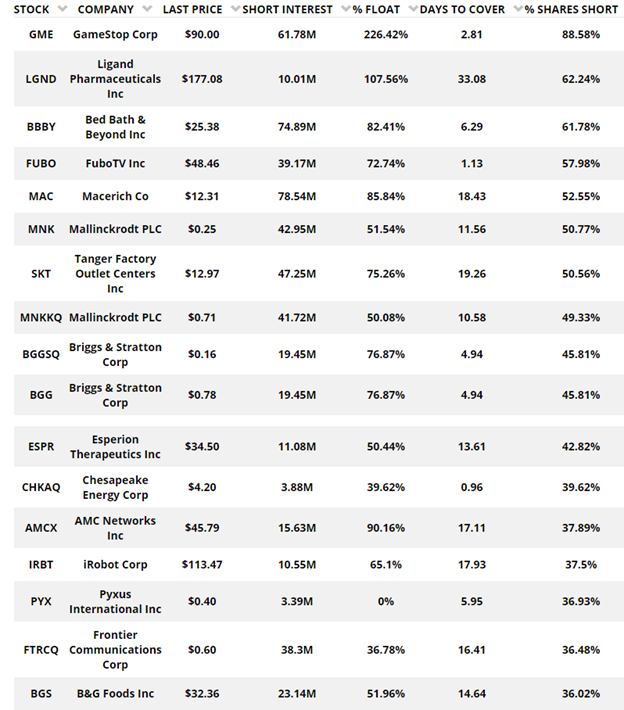

Here are a handful of Heavily Shorted Stocks that you should put on your radar so that you can see and understand price action firsthand and how scared Wall Street is of being on the wrong side of this powerful trend. Over the last week this companies have rallied heavily as Hedge Funds have all changed their enormous exposure to naked short selling.

We track and discuss these candidates in our Live MasterClass.

Regardless of your risk profile these are major issues facing every investor and trader today.

So how are you going to navigate the terrain of the financial markets?

The race to debase is very real. This economic environment is forcing traders into much shorter time frames as everyone in the marketplace chases yield.

Real asset prices will keep rising as the yield chase intensifies. Cheap capital will keep flooding the market. And our economy will continue its addiction to a horrible monetary stimulus drug that is being handed out like candy in Washington DC.

Do you have the tools and ability to find the strongest trends at right time in this economic environment? What is your plan for maintaining your purchasing power as this trend accelerates?

I’d like to invite you to visit with us at one of our live Master Class Webinars where we show how artificial intelligence is the only means to stay consistently up to date on the risk and reward opportunities in this environment.

What all traders and investors want is an accurate, proven solution that alerts you when a high probability trend is unfolding. The Vantagepoint A.I. forecasts have proven to be up to 87.4% accurate in determining the trend three days in advance.

Visit With US and check out the a.i. at our Next Live Training.

It’s not magic. It’s machine learning.

Make it count.

IMPORTANT NOTICE!

THERE IS SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.