Flat is the word. Yes, flat describes yesterday’s market, and it might have applied to the market today, given the state of the futures just before the bell.

- Traders are waiting on the data due out this morning with a bid under the futures.

The data referenced above is the manufacturing data across the globe, in particular, that of the US, Europe, and China.

- Traders appear to like the HSBC PMI data out of China, which signaled that the China’s manufacturing sector moved back into the expansion zone for the first time in 6 months in June.

- The PMI data is also out in Europe this morning. And while the numbers were a smidge below expectations, most remain in an expansion mode, particularly the UK. Manufacturing growth unexpectedly accelerated in the UK to the fastest pace in seven months as demand surged, adding to signs of a broadening recovery.

- Markit’s Final U.S. Manufacturing PMI (Purchaser Managers Index) for June was reported at 57.3.

So, what is going on today? Clearly, the market is not flat, but what is it? Is it really jumping on the data above? What about Iraq? Isn’t today’s news a downer for the market?

- Sunnis and Kurds abandoned the first meeting of Iraq’s new parliament on Tuesday after Shi’ites failed to name a prime minister to replace Nuri al-Maliki.

Apparently, the possibility of Iraq disintegrating quickly or the US getting dragged back into the sectarian violence there is not enough to dampen enthusiasm for the global upbeat manufacturing data; at least I can’t find anything more inspirational for the market this morning.

Better news yet, the market movement this morning is broad based. All major indices I track are up solidly – the Dow, the S&P 500, the Russell 2000, the MID-cap 400, the NASDAQ, and the Wilshire 5000. Interestingly, gold spiked earlier today, and now it is moving to the downside. The safe haven play is out?

Frankly, I am not reading too much into today’s market movement. It appears investors’ money is flowing into equities, and that would make sense given the recent strong flow of cash into mutual funds, but the big move today does not add up on just the news.

Then again, perhaps it is investment money driving the market today. Money managers are staring at all that cash sitting around, the market pops a bit in the a.m., the managers feel something is up, retailers sense it too, they all buy thinking they don’t want to miss the train, this catches some of the short sellers, they cover, and the snow ball begins.

Now that I think about it, the market is full of short sellers, quite a few in fact, more than usual is the word on the street. Despite all of the positive economic data as of late, (housing, manufacturing, consumer spending, consumer confidence, etc.) there still remains an undercurrent of doubt. The market hitting record highs, falling back, hitting highs again is a repeating pattern now, but voices keep telling us this is not solid, that “there is no there, there.”

Yes, I believe the market is still a bit ahead of itself, but that will all work out as earnings start again soon enough. In the meantime, take the positive data for what it is – nutrition for the health of the market. As well, ignore those who tell us that the market is not real; it is some kind of buoyant bubble held aloft only by the powerful breath of cheap money (central banks). On that note, here is me entertaining myself with my usual plaything – the hilltop screamers and other such oracles of doom.

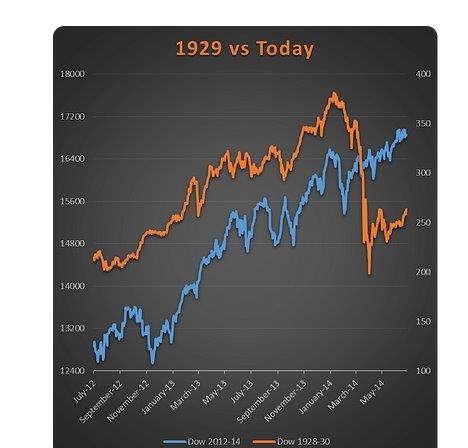

- Looks like we dodged a huge bullet, as that scary 1929 crash chart that was all over the place back in February hasn’t played out like the bears would have hoped.

I wrote about this back in February, as it was all over the Internet and it even made it to the talking head circuit. Here is the chart.

I will grant you the chart is somewhat similar, until it is not, but the fact remains the market is not supernatural, nor does it blindly follow history. Market movement is dependent on current circumstances, which, as I have written many times before, precludes the possibility of historically ordained action. All eras are different.

- Basing your outlook for today’s market purely on a chart from the ’20s is irresponsible and ridiculous. There are so many other factors at play, and those that used the charts above simply created undue fear and once again caused the masses to miss higher prices.

Well, that just about says it all, now doesn’t it?

Trade in the day; invest in your life …