The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John

Today’s Golden Sunrise

Wednesday, May 12, 2010

Hours of daily research consolidated for you

The Golden Goose

All the news is gold these days…all the market turmoil and every market pundit is now a gold bull, gold expert, and a portion of every portfolio should be in gold. Gold is THE story.

There are big numbers of momentum players that won’t even look at a group until it is hitting new highs. Of the 118 stocks hitting new highs yesterday, 13 were mining companies (the biggest segment represented) and all were gold and/or silver companies. There were 20 new lows on the day for the sake of completeness.

As an index, of the 23 IBD lists, gold retained its’ no 1 spot and was the number 1 performer on the day, up 4.4%.

As a group, Metal Ores:Gold/silver moved from 134 to 53 in a single day and was the top performer of the 197 groups IBD has created, tracks and ranks on a daily basis with a gain of 6% on average for the 89 companies included in this entity.

In the last year+ or so…gold/silver has held the number 1 group ranking and has also held the 197th spot-dead last. The number of companies (which generally means a $10 share price minimum) has moved from 104 and to as low as 56 in the few months I have been logging this. There is action in this arena of the market.

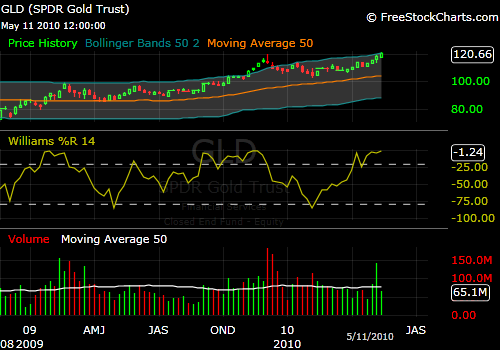

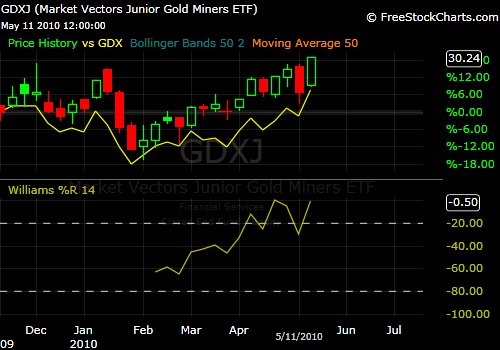

Weekly chart of the gold proxy etf above and the same chart with a comparison to the gdx etf for gold miners below. The gold stocks have been doing rather well-despite the common view that they are lagging gold itself.

The newly created gold index for the more volatile junior miners is show below with a comparison to the gdx.

Both of the gold mining etfs are excellent representation of the category. Very few people are capable of picking out individual gold stocks that will outperform the etf. The juniors are much more volatile than the volatile bigger miner gdx which is more volatile than the volatile underlying gold.

Gold is going to produce a lot of eggs…it is in a long-term bull-market but, at the same time, it moves in big chunks in both directions so your time-horizon and your timing are the keys to succeeding in the space. Jim Sinclair, likely the greatest gold trader of all-time, is on record as saying $100 daily swings will become commonplace.

Buy weakness, sell strength is what the real winners do.

I am not sure if buying weakness after gold has dropped is harder than selling after a run-up..at least partially..I hate doing either one but that is what works so I will be ringing the cash register today with things I bought earlier this week.

The golden goose can provide you with a lot of omelets but it can also cause major indigestion and vomiting if you chase price.

JohnR

Goldensurveyor.com