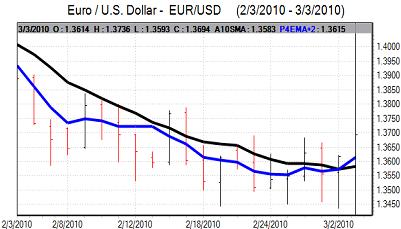

EUR/USD

The Euro found support below the 1.36 level on Wednesday and maintained a generally firmer tone during the day in a continuing correction from recent lows.

The Greek government confirmed that it would make a further EUR4.8bn in budget cuts in order to curb the budget deficit and this helped maintained a slightly more confident tone towards the Euro. There will, however, still be fears that there will be a high degree of internal opposition to the budget cuts. The mood of confidence could unravel quickly and there is still likely to be important tensions with Germany and France.

The ECB council meeting will be watched closely on Thursday even though interest rates are unlikely to be changed. Comments on the Greek situation will be important and an uncompromising stance from bank President Trichet would tend to unsettle the Euro.

The US ADP report recorded a decline in private-sector employment of 20,000 for February following a revised 60,000 decline for January with the headline figure broadly in line with expectations.

The US ISM data for the services sector was stronger than expected with an increase to 53.0 for February from 50.5 the previous month. The employment component remained below the 50 level, but did show an improvement for the month which will maintain confidence over an underlying improvement in the labour market. There will be caution ahead of the US payroll report on Friday.

The Fed’s Beige Book reported that economic conditions had improved in most regions while the decline in unemployment had eased, but hiring plans were still limited and commercial real-estate markets were still weak.

There was a further covering of short Euro positions and the currency pushed to a high above the 1.3720 level in late European trading which was a two-week high for the currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

During Asian trading on Wednesday, the yen maintained a firm tone against the dollar with a further test of support near the 88.50 level with speculation over corporate yen buying and fiscal year-end demand could start to become a feature with the new fiscal year starting at the end of this month.

The dollar continued to find support close to this technical region for much of the day, but wider losses for the US currency helped push the dollar to lows around 88.30 during New York.

There were gains for commodity prices and further gains for global stock markets which will tend to curb underlying yen demand on defensive grounds, although caution may still prevail.

Sterling

Sterling found support below 1.50 against the dollar during Wednesday, supported in part by a generally weaker US currency.

The latest PMI data for the services sector was also stronger than expected with an advance to 58.4 for February from 54.5 the previous month. This was the highest figure for three years which should provide some degree of support for the UK currency.

The currency could also gain further support if the Bank of England maintains a steady policy at the monthly interest rate decision on Thursday. In particular, there will be relief if there is no expansion of quantitative easing. In contrast, any expansion of the programme would be a substantial negative factor for the currency with volatility liable to remain at elevated levels in the short term.

Underlying confidence in the economy is also likely to remain weak which will limit the scope for Sterling recoveries. The Euro retained a firm tone above the 0.9050 level.

Swiss franc

The dollar was unable to make a fresh challenge on resistance levels above 1.08 against the Swiss franc on Wednesday and declined to lows near 1.0650 during the US session as there was a wider dollar correction weaker.

The Euro was slightly firmer against the franc with some further speculation that the National Bank was intervening in the market. The Euro should also gain support from an easing of fears surrounding Greece, although confidence could decline again quickly which will tend to limit the scope for franc selling.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

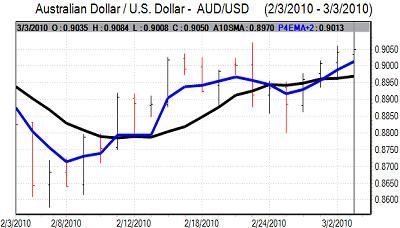

Australian dollar

The Australian GDP data was in line with expectations with a 0.9% quarterly increase which reinforced expectations that there would be further interest rate increases over the next few months.

The Australian currency was initially trapped close to the 0.90 level during the European session, but it advanced to a high above 0.9080 during New York with a generally weaker US currency and rising commodity prices providing support.