Hello Traders and Investors,

Again, as mentioned, a pretty tough week to engage in heavy trading as volume is light.

Regarding investing, the price of protection has become VERY cheap, meaning buying puts to protect the portfolio are an inexpensive way to buy insurance.

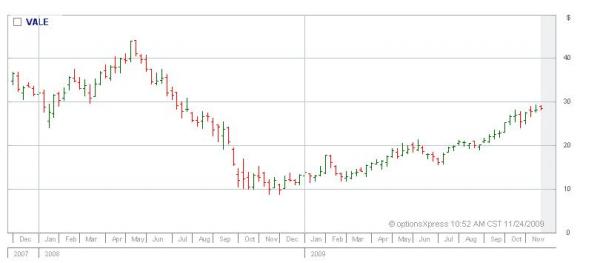

Let’s take VALE for instance – a commodity stock – and we all know how commodities have roared!

VALE had an October 2007 high around 40 and an early 2009 low of around 10. Using Fibonacci’s, VALE, now around 29 has rallied back to the 62% retracement. Selling covered calls at or above this 62% retracement is a very low risk trade AND you can bring in very high premiums (3% of the stock price in one month) if it fails at this critical level.

Now I know that many stocks have retraced more than 62% and that the economy is “firing on all cylinders” (Yeah Right!!) but let’s be honest, if you owned this stock before the crash and/or bought in as it rallied up, you have PHENOMENAL GAINS!!!! Why wouldn’t you use technical analysis to protect a very profitable position AND have the chance at generating income for very little risk.

Worst case scenarios

***The stock rallies and you get called away at 3%, keeping the stock appreciation and the 3% for selling the call

***You buy back the call you sold and roll it up and out – making back some or all of the loss you just took, but hey, the stock broke resistance.

Investors have to get over the idea of the “I lost on my covered call”. Do the math – you sold an OTM option – you are net a winner with the stock appreciation AND you are going to sell another call to generate new income.

I call this, Keep it Simple Stupid!

Happy Trading and Be Environmentally Cool