Well, we had some good plays and bad plays this week. We have a number of open positions currently moving into the end of the week. We have GFI Group (GFIG), which we got into at 4.85. We are looking to sell that at 5. We are in Trina Solar at 26.72, which most likely will be held through the weekend as we need more than a 3% gain in order to get out of this one. We are also involved in a Midterm Trade in Atlas Air (AAWW) at 52.92. We are looking to exit at 54.48 and higher. Yesterday, we closed American Express out for a 0.75% gain, and we made 2% on our Short Sale in Insteel (IIIN).

Well, we had some good plays and bad plays this week. We have a number of open positions currently moving into the end of the week. We have GFI Group (GFIG), which we got into at 4.85. We are looking to sell that at 5. We are in Trina Solar at 26.72, which most likely will be held through the weekend as we need more than a 3% gain in order to get out of this one. We are also involved in a Midterm Trade in Atlas Air (AAWW) at 52.92. We are looking to exit at 54.48 and higher. Yesterday, we closed American Express out for a 0.75% gain, and we made 2% on our Short Sale in Insteel (IIIN).

Things are looking up in the market this morning after another positive set of earnings. Since we are so toppy, I think the market is going to continue this yo-yo for some time. Up in the morning and down throughout the afternoon. We will look to get out of these positions before lunch.

Longterm Rating: Jack in the Box Inc. (JACK)

Thesis

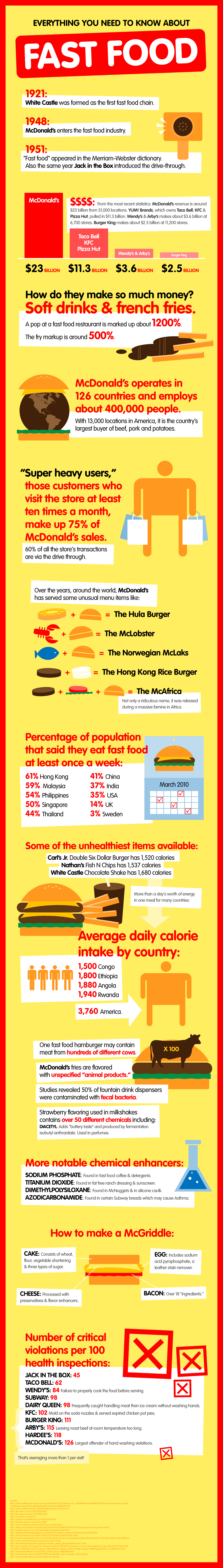

Jack in the Box Inc. (JACK) has become one of the leading fast food restaurants in the USA. Before the recession, Jack in the Box appeared to be a company that was poised for tremendous growth as it grew its revenue from 2000 to 2007 75%. The combination of unemployment and weakness in consumer spending has adversely affected JACK through declining revenue and income levels. The company is poised to see another drop in revenue this year from 2009. Despite hard times, Jack in the Box is one of the most attractive companies in the restaurant sector. The company has differentiated itself from rivals with a unique menu, a growing concept in Qdoba, and an engaging television campaign. As employment returns, Jack in the Box will find itself a severely undervalued company with lots of room for growth.

One of the best reasons to like Jack in the Box is its current undervaluation. The company has a current P/E ratio of just over 12 at 12.54. The industry average is 18.00 with competitors like McDonald’s (MCD), Burger King (BKC), and Yum Brands (YUM) with P/E ratios at 16, 12, and 18 respectively. At its 2007 revenue, JB was at at nearly $40 per share with a P/E ratio above the industry average. It now sits at less than $20 and below the…