Yesterday, we had a so-so day. We are having a bit of a rough start to the July season. We closed out our position in an Overnight Trade in Family Dollar (FDO) for a significant loss. We got involved at 39.30 on Tuesday, and I sold at the open yesterday at 37.25. It was a nice drop of just over 5% for us. We did have a successful Buy Pick of the Day, yesterday,  in Sirius XM (SIRI). We got involved at 0.98 and sold at 1.01. Our Short Sale of the Day started out looking great as we got involved at 5.42, but it went awry this morning as solar continued to rally. JASO is very overbought and overvalued, but it appears that does not matter for this one. I got stopped out at the open at 5.68 for another loss of nearly 5%.

in Sirius XM (SIRI). We got involved at 0.98 and sold at 1.01. Our Short Sale of the Day started out looking great as we got involved at 5.42, but it went awry this morning as solar continued to rally. JASO is very overbought and overvalued, but it appears that does not matter for this one. I got stopped out at the open at 5.68 for another loss of nearly 5%.

On the bright side, we are going to put the past two day behind us and chug forward. I have a great Midterm Trade for us to get involved with today, and the market is sustaining a great rally. Also, be sure to check out my latest portfolio update. We are up 43% on the year so far for the Buy Pick Portfolio. We are up 10% on the Short Sell Portfolio through the end of June.

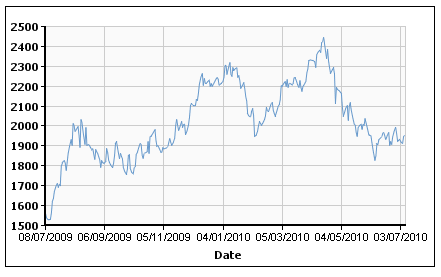

The chart on the left is one of the first main criteria for why I think today’s Midterm Trade will make a big splash.

Midterm Trade: Alcoa Inc. (AA)

Analysis: I am very excited about the upcoming earnings season. Last quarter was a great success as over 70% of companies beat estimates. A lot of companies showed great growth and were looking for more moving forward. One company that I think is poised to have a great showing is Alcoa Inc. (AA). The company is known as the mood setter for the earnings season as it is the first giant to report. The company is expected to report a profit of 0.12 per share, which is a great improvement on the -0.26 EPS the company suffered in Q2 2009. The turn to profit as well as buildup to another great earnings season gives me reason to believe AA can make some money moving into and out of earnings.

another great earnings season gives me reason to believe AA can make some money moving into and out of earnings.

The first place to look at any commodities company is the price of their commodity. At the end of March and beginning of April, aluminum prices…