Chinese auto sales are one of those pieces of data that investors can rely on to be pretty much a sure thing right now. The amount of cars being sold in the country continues to grow year-over-year from month-to-month. It is no wonder that nearly every major car company is flooding the market and commenting that China will be its next best region. Sound too good to be true? I don’t think the bubble has burst as of yet. For that reason, I turn my attention to a stock that should have a nice week based on its release of earnings on Thursday morning that is too undervalued and should see some movement throughout the week.

Chinese auto sales are one of those pieces of data that investors can rely on to be pretty much a sure thing right now. The amount of cars being sold in the country continues to grow year-over-year from month-to-month. It is no wonder that nearly every major car company is flooding the market and commenting that China will be its next best region. Sound too good to be true? I don’t think the bubble has burst as of yet. For that reason, I turn my attention to a stock that should have a nice week based on its release of earnings on Thursday morning that is too undervalued and should see some movement throughout the week.

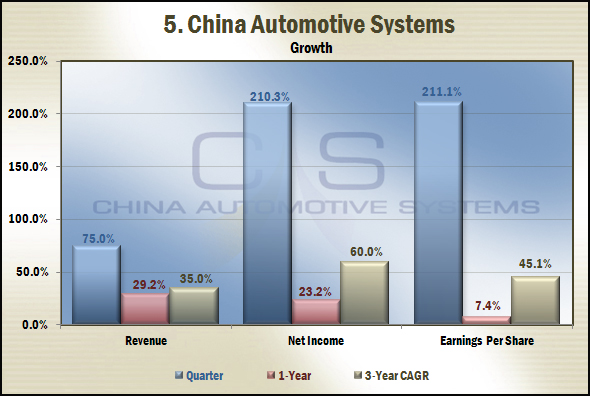

Buy of the Week: China Automotive Systems Inc. (CAAS)

Analysis: China has become the largest auto market in the world, surpassing the USA in 2009. The above graph shows the enormous amounts of growth the industry is seeing and predictions for the future. As the graph shows, the relative growth will decline, but the amount of cars selling will continue to rise and means a new source of more revenue. One company that has seen its own market share rise over the past couple years and has positioned itself well in the market is China Automotive Systems Inc. (CAAS). This company is an auto parts dealer for two of the five largest car manufacturers in China and produces power steering pumps and power steering gears to GM and VW. The company has grown with the market, and it will be releasing its earnings on Thursday. I think the stock is positioned very well to see some growth over the coming days moving into the release of earnings information.

To begin, the company is estimated to release an EPS of 0.17, which would be an increase year-over-year of 750%. The company, in the past two quarters of 2009, however, was above 0.20 EPS. I do not think there is much reason to doubt that the company will continue this streak. At the end of 2009, China continued to show its strength in the market. China saw a slight decline in growth from about 84% in September of 2009 to 79% in October. The increase went back up in November to a year-over-year increase of 98%. December was more of the same. Car sales rebounded from a low in April 2009 due to incentives and subsidies provided by the…

To begin, the company is estimated to release an EPS of 0.17, which would be an increase year-over-year of 750%. The company, in the past two quarters of 2009, however, was above 0.20 EPS. I do not think there is much reason to doubt that the company will continue this streak. At the end of 2009, China continued to show its strength in the market. China saw a slight decline in growth from about 84% in September of 2009 to 79% in October. The increase went back up in November to a year-over-year increase of 98%. December was more of the same. Car sales rebounded from a low in April 2009 due to incentives and subsidies provided by the…