Good Thursday to all. I am happy to report that our positions are all looking to be in good shape. Last night, Marriott International (MAR), our two-day Overnight Trade from Tuesday, reported solid earnings with an EPS beat of 0.31 vs. the expected 0.28 and tripled their profits. The company’s stock did not make big moves in after hours and is only up 1% in pre-market trading. We got involved at 31.95 and at least would like to get a 2-3% gain out of this one. We will hold out of the open until we get in the range 32.58 – 32.90. While the company reported very well and had good guidance, investors  do not appear to be too impressed. We also got into another Overnight Trade yesterday with Fairchild Semiconductor (FCS). This company reported earnings this morning that were also pretty outstanding. The company reported earnings per share at 0.40 vs. the expected 0.31. The company had great guidance, beat revenue, which increased 47%, estimates, and had great guidance. We are selling this one out of the gate as it is trading in the 10.30 area, and we entered at 9.60.

do not appear to be too impressed. We also got into another Overnight Trade yesterday with Fairchild Semiconductor (FCS). This company reported earnings this morning that were also pretty outstanding. The company reported earnings per share at 0.40 vs. the expected 0.31. The company had great guidance, beat revenue, which increased 47%, estimates, and had great guidance. We are selling this one out of the gate as it is trading in the 10.30 area, and we entered at 9.60.

Our Play of the Week in Advanced Micro Devices Inc. (AMD) has been up and down. We exited half our position yesterday at 7.78 as the stock got a nice boost from Intel. Today, it should be getting a solid boost as it moves into its after hours report and FCS’ report. AMD is up to 7.56 in pre-market, so we are hoping for more gains before the close today.

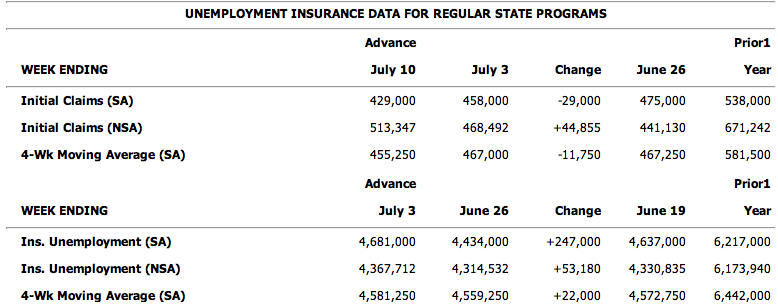

The market is looking strong today on earnings reports that were very solid across the board especially from leaders like JP Morgan (JPM) and Novartis (NVS). The Initial Jobless Claims report showed another large drop this week to 429,000 – well below expectations of 449,000.

Let’s get into today’s plays…

Buy Pick of the Day: Bank of America Inc. (BAC)

Analysis: The big news of the day is obviously the JP Morgan story. The company was expected to report profits near 0.70 EPS, but they blew that figure out of the water with an EPS of 1.09. Their net income increased 77%. What was most significant for JPM was that they were able to make a lot of their profits this quarter from reducing their loan losses rather than from their investing arm. The company only needed just over $3 billion to cover…