Good Monday Oxen Report readers,

Good Monday Oxen Report readers,

The market is looking like it is ready for a rally today as the market has dropped over 6% since hitting its high of 2010 back on January 15. On Friday, we picked up a Long Play of M/I Homes Inc. (MHO). We got into that one at 10.35 and are looking for 4-6% increase with a sell expiration on Wednesday after earnings are released. If I get 5% before Wednesday, though, I will look to sell MHO.

Let’s get into some plays for Monday…

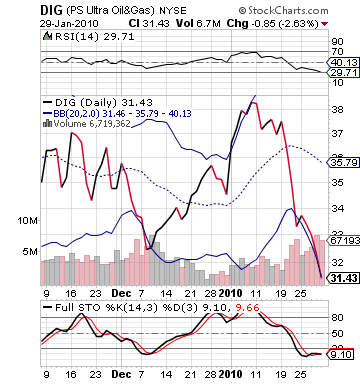

Buy Pick of the Day: Ultra Proshares Oil and Gas ETF (DIG)

Analysis: Nothing has been able to get the market going since that high, but the downturn may be looking upwards. On little news that would spark a rally, the market as of 8:15 AM had futures that were up above 55 points on the Dow. At 8:30 AM, we got some neutral economic data that did very little for the market’s direction. One of the big earnings market movers is ExxonMobil (XOM), which despite a 23% profit decline beat estimates on Wall St. and has investors a bit excited.

With the market looking up for the day, that should translate into a good day for the oil market. Oil has been on a steady decline from the 80s all the way down to now at $73 per barrel. The oil ETFs have been closely following this downward trend, and one, in particular, presents a perfect buying opportunity for the day. Ultra Proshares Oil and Gas ETF (DIG) is a great buy after the ETF has taken a 20%+ nosedive in the past three weeks. The ETF is extremely undervalued. If oil and the market can rise, then DIG is a great opportunity.

Will oil keep going up today? The first reason we can expect a solid day out of oil is that President Obama’s announcement that we would reach a record deficit has weakened the dollar significantly, which always gives a boost to oil prices. Further, it is time for a correction. Fundamentals have said that oil should be much lower than it is right now, but market fundamentals say we can only decline for so long before we get at least some sort of rebound (no matter how short lived it is).

“This is not a trend higher but a reaction after three weeks of falls. The fundamentals have not improved, the market is…