Happy Thanksgiving to everyone! Hope you all had a nice feast and day of relaxation. My beloved Green Bay Packers took home a nice victory, so it was a good day. I am feeling much better, and I think today should be a good day for us in the market. The markets are looking very, very poor today, but I still think we can find some good places to throw our money. Let’s get into today’s picks and enjoy your leftovers!

Happy Thanksgiving to everyone! Hope you all had a nice feast and day of relaxation. My beloved Green Bay Packers took home a nice victory, so it was a good day. I am feeling much better, and I think today should be a good day for us in the market. The markets are looking very, very poor today, but I still think we can find some good places to throw our money. Let’s get into today’s picks and enjoy your leftovers!

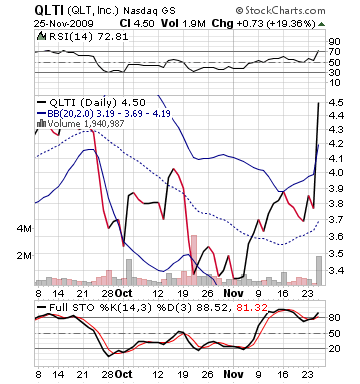

Short Sale Pick of the Day #1: QLTI Inc. (QLTI)

Analysis: Today, I do not think that there is much of a great buy. I am sure stocks will move an upwards direction at some point, but everything is looking pretty bleak. It may be safer to go with a couple of short sales that we think can work. The market is looking down on news coming out of a Dubai investment company may default on over $60 billion in loans, which would affect a multitude of financial institutions and is a sign of the still never ending state of the current economy. Futures are down over 200 points for the Dow as of 8:30 AM, and I don’t see an end in sight. Crude dropped $4.00 this morning. Stocks across the board are in the red. It looks pretty bad out there…

One stock, however, that is in the green is QLT Inc. (QLTI), which is a pharmaceutical company that produces products for use in photodynamic therapy (PDT), using light-activated drugs to treat disease. The company has rose over 20% on Wednesday on news of a settlement that went in QLTI’s favor with a hospital. The stock is still in the green this morning despite the news and the quick fire sale I am expecting. Further, the stock got a small upgrade from RBC Capital Markets. This is also helping to spark some interest but do not be fooled.

With the stocks technicals going hay wire, QLTI hit a two-month high on Wednesday. Typically, when we see a 20% gain on one day, we can expect a solid retrenchment the next day. There are just way too many quick buyers and sellers on days like that. QLTI should be no different, and with the market ready to tank, we should expect this to move into the red pretty quickly. The stock’s technicals tell the story, further. The stock was already oversold going into…