The Oxen Report Long Term Portfolio has been doing fairly well thus far in its short existence. Our first position that was opened at the end of May was with Trina Solar (TSL). We got involved at 17.65. The stock is at 18.37 currently. We have moved up about 4% thus far on Trina. Our long term short in Green Mountain Coffee Roasters Inc. (GMCR) is currently down about 2%. We were up as much as 5% from our entry of 24.05, but the stock has rebounded well in the market’s upwards movement. We now turn our attention to a new sector away from solar and food/beverage. This week we are looking at a foreign auto parts supplier that has some great long term potential.

upwards movement. We now turn our attention to a new sector away from solar and food/beverage. This week we are looking at a foreign auto parts supplier that has some great long term potential.

Long Term Position: China Automotive Systems Inc. (CAAS)

Thesis

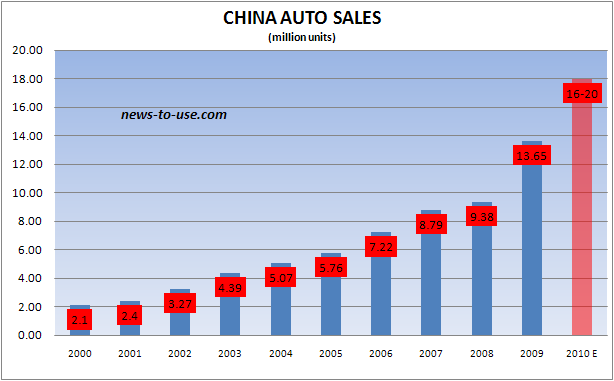

One of the most vibrant industries in the world today is the Chinese automotive industry. The nation has become the leader of automotive sales in 2010, and it looks poised to continue to grow throughout the coming years. Many have read or heard the statistic that the Chinese add some 1,500 cars per day to the streets. Chinese auto sales are estimated to grow 55% by 2015, according to JDPower.com, from nearly nine million to over 13.5 million sales. The industry looks poised for significant growth, and between all the buzz that surrounds this entry, one opportunity stands out to take advantage of this growing industry with an undervalued company.

China Automotive Systems Inc. (CAAS) has become one of the leading auto parts suppliers in the auto parts industry of China and as of January 2010 began a venture with its first North American company (the company has done business with North American companies that have Chinese subsidiaries) in Chrysler LLC. The company has grown its sales over 300% in the past five year, and the company has increased its revenue over 20% every year for the past five years. The company has  positioned itself very well to continue to see growth at these levels as it distributes over sixty Chinese automobile manufacturers including two of the five largest in FAW and Fongdeng. The company’s move into the USA via Chrysler is another terrific sign for more growth as the North American market is beginning to see strong recovery as well.

positioned itself very well to continue to see growth at these levels as it distributes over sixty Chinese automobile manufacturers including two of the five largest in FAW and Fongdeng. The company’s move into the USA via Chrysler is another terrific sign for more growth as the North American market is beginning to see strong recovery as well.

One greatest asset that the company has is significant free cash flow. The company has increased its free cash flow each year…