Good morning to all! Hope everyone was able to make some money on Constellation Brands. I, unfortunately, only got 1% out of it selling at 17.93, but it was worth 3-4% more if you were able to hold onto it this morning. STZ has been our only position thus far of the week. Alcoa is up to around 12.40 this morning, which would have given us a great Weekly Play. I, unfortunately, refused to pull the trigger outside of our range. Today, we are going to continue with the Overnight Trade, and I will be looking at a Midterm Trade that will take us into next week that we can get into this afternoon.

Good morning to all! Hope everyone was able to make some money on Constellation Brands. I, unfortunately, only got 1% out of it selling at 17.93, but it was worth 3-4% more if you were able to hold onto it this morning. STZ has been our only position thus far of the week. Alcoa is up to around 12.40 this morning, which would have given us a great Weekly Play. I, unfortunately, refused to pull the trigger outside of our range. Today, we are going to continue with the Overnight Trade, and I will be looking at a Midterm Trade that will take us into next week that we can get into this afternoon.

Let’s get into the Play of the Day…

Overnight Trade: Marriott International Inc. (MAR)

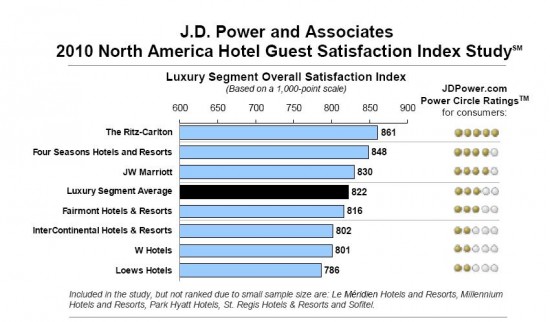

Analysis: The hotel industry has been on a smooth recovery in 2010 as businesses have been traveling more, and consumers have started to take more trips. The luxury side of hotels has actually outdone the mid-level and low-level hotels as luxury spending has returned before the other two. Entering this evening, Marriott International (MAR) is looking as though it is ready for an earnings beat. The only question is whether its technicals put it in a position where its upside is limited.

One of the best signs that a lodging recovery is occurring is bed tax collections. Those collections have been up significantly throughout this year. Revenue per available room or (RevPAR) is one of the most significant measurements of a company’s rising or falling success. UBS believes that Marriott’s RevPAR improved 6-8% from last year. In Q2, the company saw its RevPAR increase 9.8%, which took the company to an EPS of 0.32. In Q1, the company saw RevPAR decrease, and it hit an EPS of 0.22. Now, estimates for this quarter are coming in at 0.22 – 0.23. With rising RevPAR, should the company be making the same amount as Q1?

An increasing RevPAR means that the company is increasing both its occupancy rate and its room rate at the same time. This is very beneficial to a company. FBR Capital thinks MAR outperformed RevPAR as well.

From FBR, “Given RevPAR trends so far through 3Q and conversations with our various industry contacts attesting to the return of business travel and strengthening of rate, we believe 3Q domestic RevPAR was above the high end of guidance.png) provided by MAR (+5% to +7% for North American hotels) and…

provided by MAR (+5% to +7% for North American hotels) and…