Hello everyone. We are in the heart of the earnings season, and it is time for another Overnight Trade opportunity for you all. On Tuesday, we got involved with a successful trade in Century Aluminum Co. (CENX). The company reported earnings that appeared below estimates, but they were actually successful earnings once a one-time charge was refigured into the EPS. We got involved at 14.10 on Tuesday, looking to sell around the open of Wednesday. The stock opened at 14.20 and jumped to 14.40s within minutes. I exited at 14.35 for a 1.75% gain. The stock continued to skyrocket into the 14.60s. Let’s hope today’s selection can have as much success.

Hello everyone. We are in the heart of the earnings season, and it is time for another Overnight Trade opportunity for you all. On Tuesday, we got involved with a successful trade in Century Aluminum Co. (CENX). The company reported earnings that appeared below estimates, but they were actually successful earnings once a one-time charge was refigured into the EPS. We got involved at 14.10 on Tuesday, looking to sell around the open of Wednesday. The stock opened at 14.20 and jumped to 14.40s within minutes. I exited at 14.35 for a 1.75% gain. The stock continued to skyrocket into the 14.60s. Let’s hope today’s selection can have as much success.

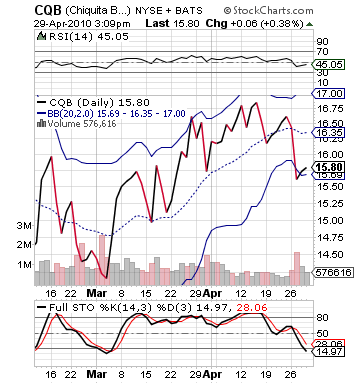

Overnight Trade of the Day: Chiquita Brands International Inc. (CQB)

Analysis: Chiquita is the lovely banana producer based in my childhood hometown of Cincinnati, OH. The company produces bananas in Latin America and sells them throughout North America and Europe. They also produce other produce, healthy snacks, and packaged salads. The company is definitely the market leader in bananas, and the company has actually done quite well in the market’s downturn. Yet, the company is undervalued and positioned for a bounce on what should be better than expected earnings. One year ago, the company reported record numbers and is expected to continue that trend, so why the gap?

At the end of March, Chiquita released some rather bearish news that has declined the stock over 5% in value over the past couple weeks. The company commented that they do not to expect to hit their EPS mark from one year ago due to lowered food prices in Europe. The company has seen an 11% decline in banana prices over one year ago, and the company believes that this will have a negative impact on results. Now, the company hit an EPS of 0.51 one year ago. This quarter, prior to the news, they were expected to be at 0.59 with a revenue $870 million. If the company saw an 11%  decline in prices, they would see at most a $90 million decline in revenue, but there industry is not all in Europe. They have about 50% of their revenue coming from Europe. That is a $45 million decline. An $825 million revenue would put their EPS around 0.30. They made $850 million in revenue in Q1 of 2009 and had an EPS of 0.51. They had $800 million in revenue in Q3…

decline in prices, they would see at most a $90 million decline in revenue, but there industry is not all in Europe. They have about 50% of their revenue coming from Europe. That is a $45 million decline. An $825 million revenue would put their EPS around 0.30. They made $850 million in revenue in Q1 of 2009 and had an EPS of 0.51. They had $800 million in revenue in Q3…