Happy Tuesday. It does not look like today will be a Turnaround Tuesday as the market futures are at the lowest levels I have seen in some weeks. The market got some fresh fearful news from a number of places in the global space. First, China’s markets dropped over 2% as the country did not respond well to a new deal with Taiwan and Japanese news that the country had a major slow down in May. Then, Greek workers walked out today on their jobs fearing wage cuts and debt worries. It has gotten Americans scared, and on a slow day of our economic data and earnings, this appears to be king.

We have three open positions moving into the session today. First off, our position in Micron (MU) looked all but great in after hours even though the company reported record profits, margins, and revenues. Accounting charges and one-time charges confused investors due to an acquisition, and the price is moving southwards. We sold 1/2 our position at 10.04, and I am going to be exiting the other 1/2 this morning before it gets any worse. Most likely this will help us break close to even. Our Play of the Week in Schnitzer Steel (SCHN) is a bit underwater for us. We got involved yesterday at 42.50. The stock is definitely not going to get a big gain today, but we have a stop loss set at 40.90. Finally, we held over our Short Sale of the Day from yesterday, which I think was a good decision. We got involved with a short sale of News Corp. at 14.68, and we are looking to exit 14.39 – 14.25. The stock closed yesterday at 14.65.

confused investors due to an acquisition, and the price is moving southwards. We sold 1/2 our position at 10.04, and I am going to be exiting the other 1/2 this morning before it gets any worse. Most likely this will help us break close to even. Our Play of the Week in Schnitzer Steel (SCHN) is a bit underwater for us. We got involved yesterday at 42.50. The stock is definitely not going to get a big gain today, but we have a stop loss set at 40.90. Finally, we held over our Short Sale of the Day from yesterday, which I think was a good decision. We got involved with a short sale of News Corp. at 14.68, and we are looking to exit 14.39 – 14.25. The stock closed yesterday at 14.65.

Let’s get into today’s play of the day. The chart on the right helps our SCHN position and a new one for today.

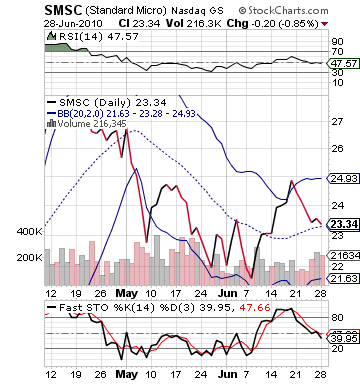

Short Sale of the Day: Standard Microsystems Corp. (SMSC)

Analysis: Recommending a Buy Pick out of the gate seemed a little too risky this morning, so I decided to wait for our Buy Pick towards the afternoon for a late day breakout. So, we will start with a Short Sale of the Day instead. The market is looking to pretty beaten up this morning. Futures on the Dow were down 112 points at 8:00 AM, 116 at 8:15, and 111 at  8:40 AM. The market does not have a lot of catalysts to get it going, and it…

8:40 AM. The market does not have a lot of catalysts to get it going, and it…