Good Monday to all. Hope everyone had a refreshing weekend. This morning we are looking closely at the China Sunergy earnings. The company reported EPADS at 0.38 vs. the expected 0.26 for a surprise of over 45%. The company saw revenues  rise 57% to beat the street at $125.8M as shipments rose over 60%. The company did report they believe they will see margins decline in Q4. The stock is up close to 7% in pre-market trading. We are looking to exit CSUN at the open and take whatever gains we can get. FSLR and STP are up in pre-market, but they are not at sellable levels yet.

rise 57% to beat the street at $125.8M as shipments rose over 60%. The company did report they believe they will see margins decline in Q4. The stock is up close to 7% in pre-market trading. We are looking to exit CSUN at the open and take whatever gains we can get. FSLR and STP are up in pre-market, but they are not at sellable levels yet.

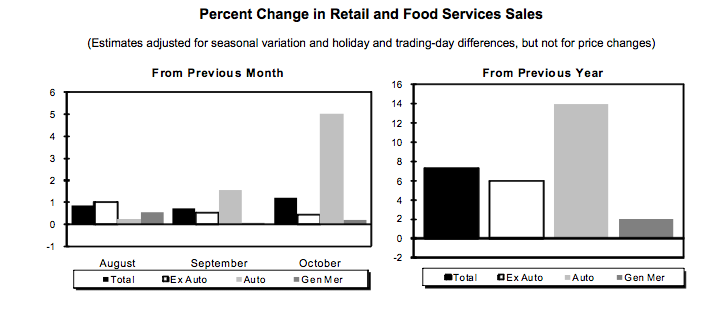

The market is looking strong to start the week with retail sales coming in at their highest levels since March. The chart I showed on Friday predicted this would occur. Since we only have one spot left in the Buy Portfolio, we will reserve it for a Play of the Week. We will look to the $5 List and Longterm Ratings for a possible Buy candidate and Short Sale candidate later this morning.

For now, here is our Weekly Buy…

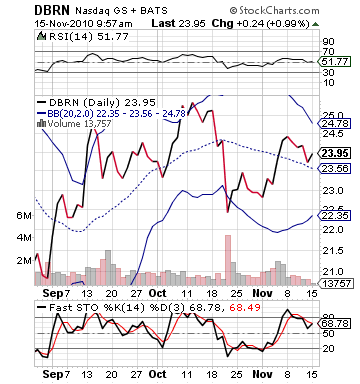

Play of the Week: The Dress Barn Inc. (DBRN)

Analysis: Retail is looking pretty strong to start off the retail earnings season. Today, retail sales were reported as improving 1.2% in October, which was the highest increase since March. This week, Nordstrom, Urban Outfitters, Abercrombie & Fitch, Saks, and many more report their earnings. One company that is looking for a very solid Q1FY11 is The Dress Barn Inc. (DBRN). The company specializes in operating The Dress Barn and Justice stores mainly. Dress Barn is a mid-level fashion store that offers casual to business wear to women in their 30s – 50s. Justice is a young girl to pre-teen retail store.

The company is slated to report earnings on Thursday afternoon. The company is slated to report EPS at 0.62 vs. one year ago at 0.33. Such a large increase in earnings typically would make one think that a stock has pretty  strong valuations. Yet, in one year the stock has only jumped a bit over 10%, and the stock is currently undervalued. The company tends to beat EPS estimates, and they beat one year ago by over 15%.

strong valuations. Yet, in one year the stock has only jumped a bit over 10%, and the stock is currently undervalued. The company tends to beat EPS estimates, and they beat one year ago by over 15%.