Good Monday to all! I hope everyone enjoyed their weekend. We are ready to move into another week of earnings, and we are starting out this Monday in a few positions still. We are currently holding positions in Trina Solar (TSL) with an entry of 26.72. We are looking to exit at 27.50 or higher. We are also involved in GFI Group (GFIG) at 4.85, and we are looking to exit at 5. Finally, we are involved with Atlas Air Worldwide (AAWW) at 52.92, and we are looking to exit at around 54.48. The company reports earnings tomorrow, so we will want to exit at least some of the position today to lock in some gains.

Good Monday to all! I hope everyone enjoyed their weekend. We are ready to move into another week of earnings, and we are starting out this Monday in a few positions still. We are currently holding positions in Trina Solar (TSL) with an entry of 26.72. We are looking to exit at 27.50 or higher. We are also involved in GFI Group (GFIG) at 4.85, and we are looking to exit at 5. Finally, we are involved with Atlas Air Worldwide (AAWW) at 52.92, and we are looking to exit at around 54.48. The company reports earnings tomorrow, so we will want to exit at least some of the position today to lock in some gains.

The market is looking to open in the green and all of our positions look to be ready to pop up this morning. The market has done a lot of popping and dropping, however, the past few sessions, so we will have to wait and see if we can sustain gains.

We are going to start things out this week with a new Play of the Week that will hopefully earn us 3-6%…

Play of the Week: Skechers Inc. (SKX)

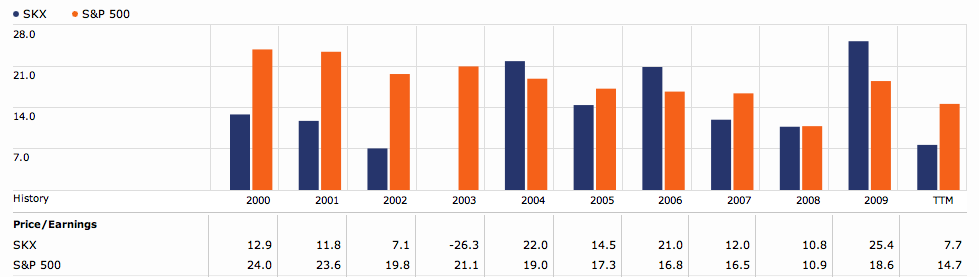

Analysis: We have quite a relationship with Skechers Inc. (SKX). It is rated as a Hold on our Longterm Ratings with a FV estimate in the upper 20s. The stock is a Buy below 24. This week, however, the stock is reporting its earnings on  Thursday morning. The company is poised to hit an EPS of 1.02 vs. one year ago 0.52 – a solid gain for SKX of almost 100% in profits per share. The stock has plenty of potential to move into earnings at least 3% or more.

Thursday morning. The company is poised to hit an EPS of 1.02 vs. one year ago 0.52 – a solid gain for SKX of almost 100% in profits per share. The stock has plenty of potential to move into earnings at least 3% or more.

One of the main reasons the company will move is that the stock is volatile and buzz oriented. The last four earnings for SKX have all produced 10%+ surprises. Last quarter, it was an 80% surprise, and one year ago, the surprise was over 40%. When a company, in the past, has had very positive results it tends to attract traders into the stock before earnings as well as investors. They are expecting the company will be able to produce another round of over-the-top results and don’t want to miss the wave. What ends up happening then is that the stock becomes overvalued and prices in earnings beforehand, and they usually disappoint to the homerun stature and fall.