Happy Monday everyone. Hope you all had a fantastic weekend. We are looking to start off this week on a good foot with a weekly position. On Friday, we took an examination of a new Longterm Position in fast food restaurant parent Jack in the Box Inc. (JACK). My fair value estimate on JACK is at the low 30s, so this one has a ways to go. Additionally, we have a current position in a Midterm Trade from Thursday in Sunpower Corp. (SPWRA). We got involved at 12.80 and are looking for 4-6% on this one before it reports earnings tomorrow evening. The stock opened up today in the low 13s, so we are close to halfway there.

Happy Monday everyone. Hope you all had a fantastic weekend. We are looking to start off this week on a good foot with a weekly position. On Friday, we took an examination of a new Longterm Position in fast food restaurant parent Jack in the Box Inc. (JACK). My fair value estimate on JACK is at the low 30s, so this one has a ways to go. Additionally, we have a current position in a Midterm Trade from Thursday in Sunpower Corp. (SPWRA). We got involved at 12.80 and are looking for 4-6% on this one before it reports earnings tomorrow evening. The stock opened up today in the low 13s, so we are close to halfway there.

Let’s take a look at a Weekly Position. Additionally, after that, I will be finishing up a Portfolio Update to show you my current statistics and portfolio success rate.

Play of the Week: NVIDIA Corporation (NVDA)

Analysis: NVIDIA moving into this quarter’s earnings report has not had the most upbeat outlook. The downward spiral for NVDA began with the company reporting outlook below estimates in its Q1 of 2010. The company was expecting revenue, at that time, of $950 to $970 million. That report came at the beginning of May. At the end of July, the company cut forecasts even further to revenue of $800 to $820 million. Since the beginning of May, the share price of NVDA has  dropped more than 50%.

dropped more than 50%.

So, why would we want to get involved with a company that is not expecting good things. The reason is because even at these revenue levels I think NVDA will be able to beat earnings estimates. One year ago, the company produced a revenue of just over $775 million and recorded an EPS of 0.07. With a revenue of $900 million, the company hit an EPS of 0.19. The company, therefore, hits another 0.01 for every $10 million of revenue. The company is still estimated by most analysts to hit a revenue of $830 million or so, which would give the company another 0.05 – 0.06 of EPS, meaning an EPS of 0.12 – 0.13, at the lowest.

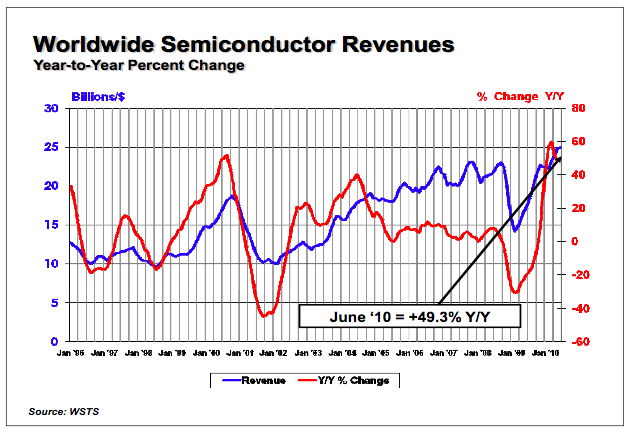

Yet, nearly every specialized semiconductor has had significant beats on earnings and revenue. Despite the warning from NVDA, I still feel confident in the entire sector. Since the beginning of July, nineteen out of the twenty-two specialized semiconductors to report earnings beat estimates. Close competitors of NVDA,…