Well, well, Happy Thursday to all! I am glad to have let Exide Technologies (XIDE) ride overnight yesterday. I got involved at 4.00 yesterday afternoon, and I had a meeting all afternoon that did not allow me to sell in the afternoon. Typically, I would have taken the 7% gain before earnings; however, am I glad I did not. Exide reported earnings at 0.53 EPS vs. the expected 0.04 and one year ago’s -0.83. The improvement year-over-year is a whopping 165%. Wow! But, the best part of the earnings is that the company is trading up over 20% in pre-market trading. 20%!!! I am going to sell as the market opens for gains of near 30% if it holds up going into the open. The chart to the left I thought was pretty interesting to see how various top nations rank on satisfaction. So, when you think that people around the world dislike us, in reality, they just really dislike their own nations.

Yesterday, our other position was in Hovnanian Enterprises (HOV), the residential construction company. HOV was able to make a solid 3% gain yesterday for our Buy Pick of the Day moving from our entry at 6.00 in the morning to 6.18 later in the morning after a big rise on the pending home sales news. Finally, our only other open position is Tuesday’s play of the week in Quiksilver Inc. (ZQK), which we entered at 4.60. The company reports earnings tonight and is already up to 4.75 in pre-market trading. We are looking for an exit of 4.78 – 4.87.

Good luck today and here are our new picks…

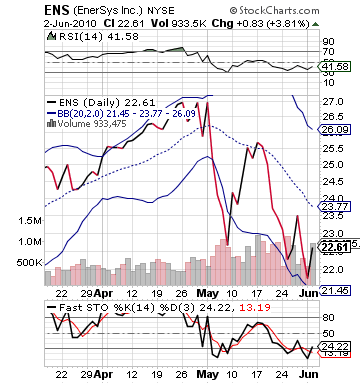

Buy Pick of the Day: EnerSys (ENS)

Analysis: To continue the success of Exide Technologies, I am turning my attention to one of Exide’s closest rivals in EnerSys (ENS). EnerSys makes industrial batteries. Exide does both industrial and automotive batteries. EnerSys is slightly larger than Exide, but with the earnings that Exide had, it should be giving a huge boost to an extremely undervalued company in EnerSys. ENS just released their own earnings on Tuesday, and they were slightly better than expected. The company did not get a huge boost from them, but these Exide earnings should really give this stock a nice nudge along with a market that is looking upwards.

The market is digesting several job indicators. The ADP Non-Farm Employment numbers came out just under expectations, but they were a great improvement…

The market is digesting several job indicators. The ADP Non-Farm Employment numbers came out just under expectations, but they were a great improvement…