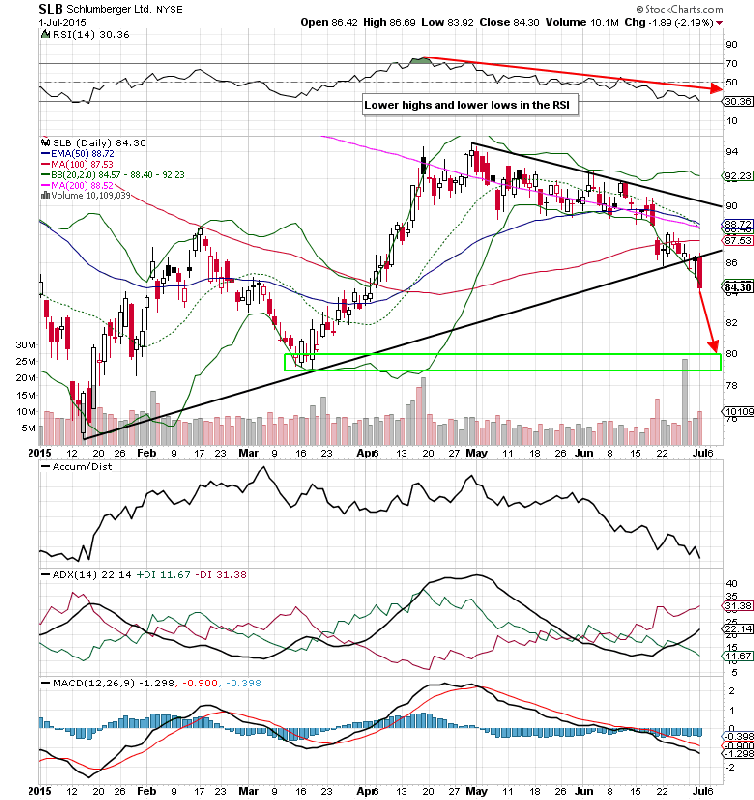

The world’s largest oilfield services company didn’t go unfazed by the pullback in energy prices (U.S. crude oil inventories rose more than 2M barrels in the last week) on July 1st and some analysts don’t see them hitting earnings targets for 2015 or 2016. On June 29th, Credit Suisse lowered their 2015 EPS estimates on Schlumberger to $3.50 from $3.90 and $3.51 from $3.88 for 2016. Using their 2016 target, the stock trades at a rich 24.02x earnings even after the latest pullback. SLB currently trades at a price to sales ratio of 2.30x and a price to book ratio of 2.91x. Exploration activity across the globe remains flat and margins are coming under pressure. On June 12th, RS Platou reiterated their sell rating and a $70 price target.

Unusual Options Activity

2,000 July 31 weekly $83.50 puts were bought for $2.01 on July 16th. This trader is either looking for protection or an outright bearish bet that encompasses Q2 earnings out on July 16th and through the end of the month.

The uptrend in SLB that had been in place for most of 2015 appears to be coming to an end for now. On July 1st, the stock printed a bearish hammer candlestick, closing below the 6-month uptrend line (printing lower highs prior to this). Consider taking a bearish options position now, looking for a retest of the March lows near $79-$80.

Schlumberger Options Trade Idea

Buy the July 31 weekly $79/$84 bear put spread for a $1.60 debit or better

(Buy the July 31 weekly $84 put and sell the July 31 weekly $79 put, all in one trade)

Stop loss- None

1st upside target- $3.20

2nd upside target- $4.80