It’s very hard to get enthusiastic about the markets on such a sad day.

I’m reporting from Las Vegas this morning so I’ll keep this brief as I’m a bit behind already. We have a couple of good articles to mark his passing on the main page so I won’t make this another one – I’ll just repeat what I said to Members last night: He was our Willie Wonka of gadgets – showing us new and wondrous things that he clearly made for his own enjoyment but was kind enough to share with us and smart enough to make a fortune doing it.

As to AAPL’s stock. Steve’s death is long priced in and the stock would be at least $500 if he were still alive and healthy. If Tim Cook can prove that AAPL remains on track this quarter and next, we will see AAPL move that way this year. I would say buy on the dip but, looking at the pre-market movement – I don’t think there will be a dip past the one we’re already seeing.

The other big news of the day is the BOE not just holding rates steady at 0.5% but also increased the size of their asset-purchase program by $116Bn, bringing this round of QEQE (Queen Elizabeth) to $426Bn. That’s 5% of the UK’s $2.25Tn GDP, that would be the same as the Fed doing a $750Bn round of Quantitative Easing. Although the ECB did not respond in kind this morning (they did keep their rates steady), with Trichet stepping down no one expected it until the new regime takes over anyway.

The other big news of the day is the BOE not just holding rates steady at 0.5% but also increased the size of their asset-purchase program by $116Bn, bringing this round of QEQE (Queen Elizabeth) to $426Bn. That’s 5% of the UK’s $2.25Tn GDP, that would be the same as the Fed doing a $750Bn round of Quantitative Easing. Although the ECB did not respond in kind this morning (they did keep their rates steady), with Trichet stepping down no one expected it until the new regime takes over anyway.

Meanwhile, the World’s 5th largest economy just announced a 5% stimulus package so it’s probably not a good time to bet the markets lower! Unfortunately, the announcement did knock the Pound down from $1.55 to $1.53 (1.3%) and the Euro fell from $1.34 to $1.325 (1.1%) and that sent the Dollar up from 79.4 back to 80 (0.75%) and that took some of the wind out of what was a very big futures rally but we held our 1.5% lines yesterday (as expected in the morning post).

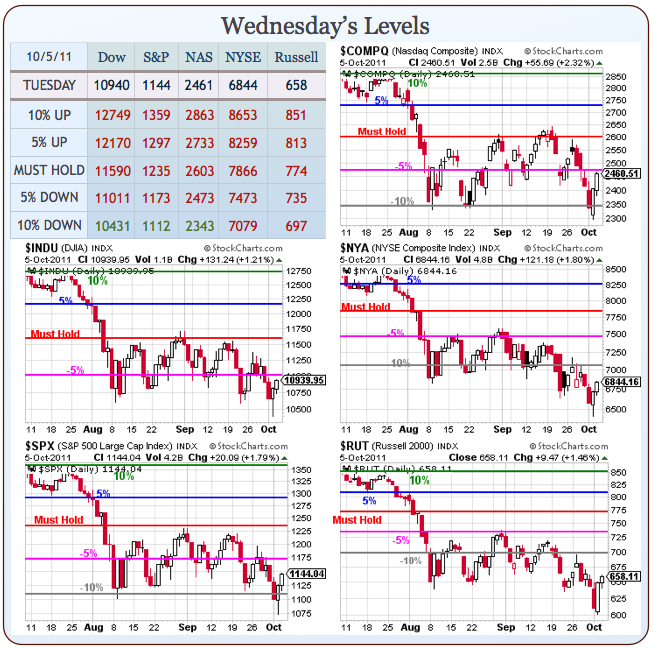

Unless the Dollar pops 80 (very doubtful), we should be testing those -5% lines on the Dow, S&P and Nasdaq as well as the -10% lines on the NYSE and the Russell – eventually, but maybe not today.…