A few years ago we all blamed Greece and their mismanaged government for causing the beginning of the European crisis and general turmoil in the financial markets. The rating agencies practically destroyed any financial attraction the investors would have towards this country.

However, no adversity lasts forever. In this case, the tide is turning around as many big hedge funds have started dipping their capital into the Greek economy. One of the big names that has already gone into the Greek banking sector has been Paulson & Co. who has taken a substantial stake in Piraeus and Alpha, the two banks that have emerged in the best shape from the crisis.

WHY GREECE AND NOT OTHER PIIGS?

One of the main reasons why many funds are looking at Greece rather than Spain or Ireland is because of the difference in their banking systems.

The financial institutions in Greece were basically victims of economic mismanagement, whereas in the other two PIIGS countries, the problem relied basically in their banking systems, which had such big problems that eventually caused a broader crisis.

THE RALLY

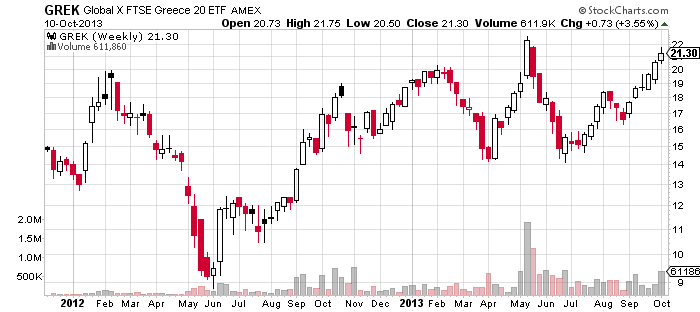

One of the most representative exchange traded products of Greece is the Global X FTSE Greece 20 ETF (GREK). This ETF seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the FTSE/Athex 20 Capped Index.

As we can see on the weekly chart, the price went from an all-time low of $8.78 in June of 2012 to a closing price of yesterday of $21.30. This almost 150% rally is proof that smart money is entering the Greek economy.

BUY ON DIPS OR BUY ON BREAKOUT

Two different strategies can be employed here if one is considering entering this ETF. The first is to wait for a pullback and enter GREK around the September low level of $16.75. A second way of looking at this trade is to buy on a breakout above the high level of May of $22.63.

The decision really depends on the profile of the trader.

Either way, now that we know that the investments funds are re-entering the Greek market, it is time we put this ETF on our radar and track it as we could earn some interesting profits betting on the same side as smart money.