The greenback is finally back and this time it’s returning with a powerful bang. Yesterday’s jump in the U.S. dollar index was quite encouraging.

One of the currencies that has fallen nearly 25% against the U.S. dollar since November is the yen, after Japan unveiled a series of aggressive moves to spur growth in its economy.

The brightening U.S. job prospects helped catapult the dollar over the key triple-digit threshold against the yen.

ELLIOTT WAVE

From the beginning of February of this year we can see a positive Elliott wave count on the U.S. dollar index daily chart. The first four waves have already completed their extensions as we are currently riding a bullish fifth wave.

Should the price continue rising and break above the high of wave three (83.608), we might see the 84.00 level sooner than expected and this could lead to a continuation of this powerful wave five

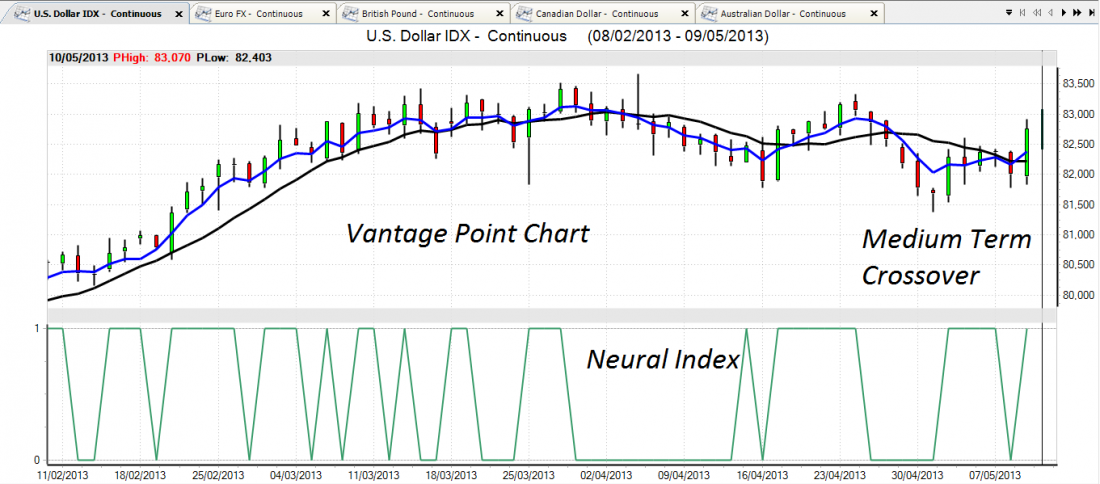

On the Vantage Point chart, we can also see the first signs of new strength as the Predicted Medium Term Crossover is currently edging above the 10 day simple moving average. This is a bullish sign for the dollar. The Predicted Neural Index also points out that the market is expected to move higher over the next few days.

BOTTOM LINE

As I mentioned in a previous article, the U.S. dollar index might not be affected this year by the “sell in May and go away” effect since in the past three years the month of May has proved to be positive for the greenback.

Finally, it’s important to keep an eye on the movements of the Federal Reserve in case the institution decides to decrease the monthly amount of the quantitative easing program sooner rather than later. This should push up the bullish sentiment of the U.S. dollar.

Click here to see the performance of the U.S. dollar index in May of the past three years.