SPX: In two weeks the Fed says they will raise interest rates. Wanna bet?

Two weeks from today the Federal Reserve will convene its Federal Open Market Committee meeting, and reveal to the rest of us their plans for an interest rate increase – if any. We’ve been here before, of course. The Fed has promised/threatened a rate increase at every FOMC meeting this year. But this time about 70% of market participants thinks it will happen, the first rate increase in almost a decade.

Well, maybe. We’re skeptics. The Fed has cried wolf so often that disbelief has become our default state – and that may be the strongest argument supporting an increase.

They have played this game so often that their credibility is in tatters; they may raise rates not because the situation demands it, but because nobody will ever believe them again if they back out this time.

Nevertheless the economic data that looked so good back in November – especially the employment data – is looking bedraggled right now. In fact the recent economic reports make a strong argument for backing away from a rate hike. Things don’t look good, and a rate increase in bad times could easily cripple the stock market. Consider:

- Economic data – almost all of it — is crummy. The revised GDP numbers were released last week, and they show 2.1% growth in the third quarter. Not terrible, but not great either. But the Atlanta Fed just released its updated estimates for Q4 and they see GDP growth at 1.4%, about half of the consensus estimate. The Atlanta Fed is right most of the time. Their number is terrible … so terrible it makes us wonder if the Fed will dare increase rates in December

- A lot of the nominal growth in GDP has come from a build in business inventories. Companies increase inventory if they think sales are going to rise; but they also build inventory – accidentally – when the stuff they manufacture doesn’t sell. The sales data are ‘disappointing’ (as we discussed on Monday) and corporate profit are declining — down about 10% in the last two quarters and expect4ed to fall further in Q4 — even as inventory builds. Not good.

- Margin debt – the money investors borrow to buy stocks — is going down. That doesn’t sound like a bad thing, but there is lots of evidence that a decline in margin debt is often followed a couple of months later by a decline in the market. In 2000 and again in 2008 it was one sign of a top. This year margin debt is down more than 10% from the peak in April. Meanwhile stock valuations are at historic highs, but investor net worth is down. That can’t last.

We think the Fed is having second thought about that rate increase. It may not be enough to make them bail, but they can’t be very happy about their decision.

Today

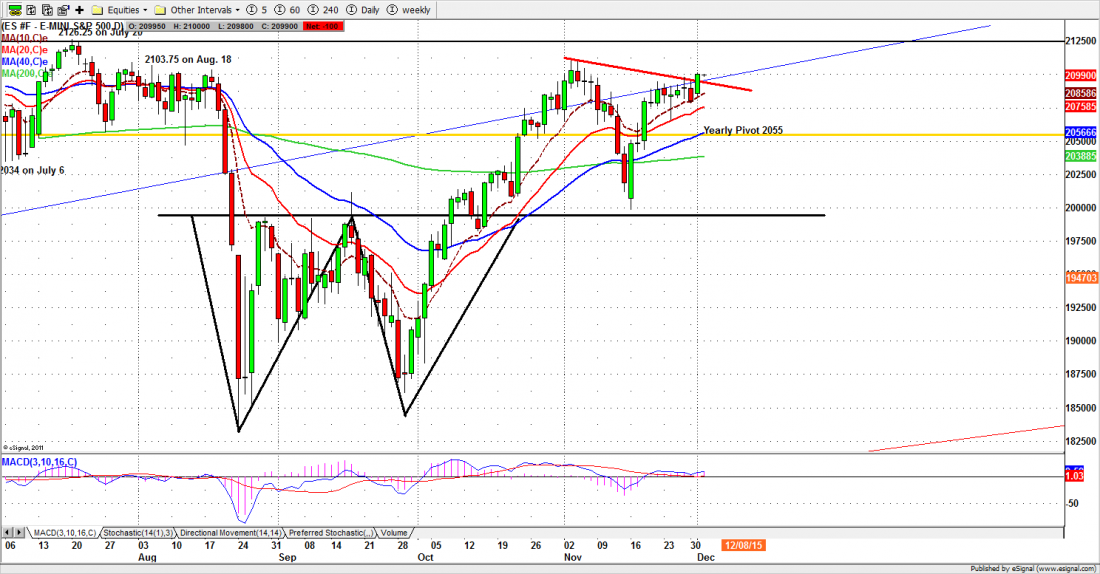

None of this is having the slightest effect on the stock market. The S&P500 mini-futures (ESZ5) got news yesterday that the ISM factory activity index is at six-year lows and still rallied back above 2100 for the first time since the beginning of November. Data, shmata. Who cares!

If the market holds above 2100 expect it to move higher. 2079-82.50 is currently an important support zone. Buy on the dip as long as this support holds.

Major support levels: 2086-83, 2075-74, 2062-64, 2050-45, 2030.50-32.50

Major resistance levels: 2114.50-16.50, 2121-23.50, 2135-38, 2156-58

For detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/

Chart: ESZ5 Daily chart Dec. 1, 2015