Last week was a very successful one for the bulls. Not only were our key Volume Profile milestones reached on Wednesday, Thursday and Friday, but the consistency of the advance was a sign that the bulls have control of the football going into earnings season.

With the super-strong dollar, multi-nationals are likely to have pricing issues, which should translate to top line weakness (revenue). This is old news, however, and the fact that the rumor has not already been sold, suggests that the “bad news” is already priced in.

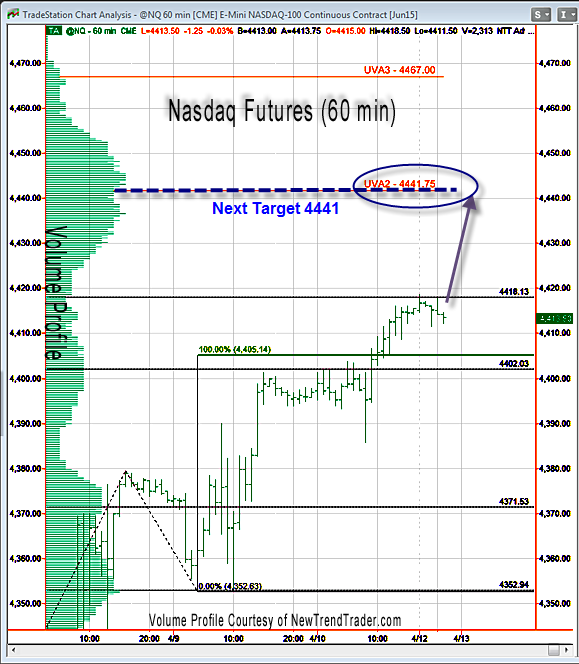

The next upside target is 4440, which in Volume Profile terms is the Upper Value Area (UVA) two standard deviations above the Volume Point of Control, which is currently at 4135 (not shown on this chart.) That’s what UVA2 stands for. And above that is the 3rd Standard Deviation level at 4467.

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the Nasdaq futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs.

#####

If you would like to receive a primer on using Volume Profile, please click here.