By: Arkady Gevorkyan

X, FCX and NUE Hold Their Support Levels

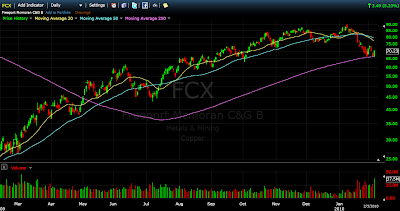

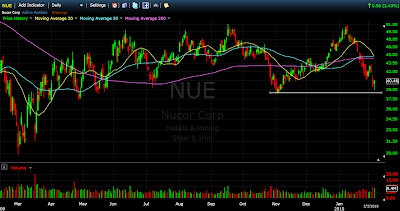

As I scanned the market and different sectors I typically trade Friday afternoon, I noticed interesting developments in United States Steel Corporation (X), Freeport-McMoRan Copper and Gold Inc. (FCX), and Nucor Corporation (NUE). I trade these stocks often and Friday offered very calculated long setups in all 3 names. Keeping in mind market’s recent volatility and its extreme oversold condition I began looking for longs Friday afternoon. Around 1:30PM I noticed that X, FCX, NUE were all roughly holding earlier lows of the day while the market was making significant new lows leading me to think classic double-bottoms may be forming. I knew I would look to these stocks for longs if the market were to bounce later in the day.

To find more support for my thought process I stepped back to a larger timeframe and scanned the daily charts for a possible setup. X and FCX were sitting right on their 200-day moving averages (one the biggest technical indicators I follow) which clearly indicated a huge support level. NUE had support from its November lows at $38.32 and was trading $0.60 above it. Initiation of the long position had small, defined risk and offered substantial potential reward at those levels. The long trade, in fact, paid off and played out later in the day.

These stocks held their levels and screamed higher as the market rallied. Last time X touched its 200-day moving average was in November 2009 at $33.25. After that it doubled in the price and never looked back before the latest sell off. This time the move higher may not be as extended but Friday’s lows can be used as a great support level going forward. Clearly, I cannot accurately predict where the stock will go from here but I was able to buy with a very tight stop and profit from the bounce. I will continue trading these stocks with a long bias until proven wrong.

For FCX Friday was the first time the stock touched its 200-day moving average since the current market rally began and it held very nicely. Should the stock continue to range between $73.25 and $66.00 levels, a hard move lower through the moving average should be anticipated. Yet, until that happens I will consider the stock a long and look to buy on pullbacks.