The Fed did nothing – yay!

The Fed did nothing – yay!

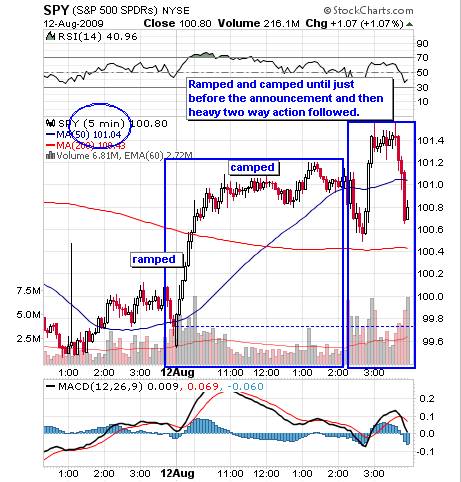

That’s the take on the futures market, which are up about 1% this morning. We thought we were pretty clever taking some bearish bets into the post-Fed rally (see David Fry chart)as it seemed a little overdone and those bets paid off into the close but holding them overnight was a huge mistake so far as the dollar dropped a point, mostlysince Europe’s open (but not against the Yen, of course tokeep Japan happy) and that plus theIEA upgrading their demand outlook(despite OPEC disagreeing) has sent oil flying back to $72 and gold back to $960 and thecommodity pushers are sll singing happy days are here again, keying off Bernankes promise to continue to “employ all available tools to promote economic recovery and price stability.“

Now price stability may sound like a good thing but it’s not because Ben is not promisingthe USconsumers that prices will remain low, Ben is promising us, the investing public, that he will not allow deflation to harm our long-term investments so we should BUYBUYBUY because he also promises to keep “exceptionally low levels of the federal funds rate for an extended period.” I always think it’s funny when conservatives complain that the government shouldn’t be telling people what to do but here is the Federal Reserve telling us exactly how they want us to invest our money. They’re NOT going to give you a high interest rate for keeping it in the bank so you’d better get it off the sidelines and into stocks and commodities, where they do promise to use “all available tools” including the purchase of $1.2Tn of agency mortgage-backed securities and up to $200 billion of agency debt by the end of the year. BY THE END OF THE YEAR! Wow, that’s $350Bn a month. Hey Mr. Chairman, I have some mortgage backed securities I’d like to sell. Mr. Chairman. Mr. Chairman. Ben…. Darn, he’s gone – maybe next month….

As I said in my Alert to members just after the Fed yesterday, the statement is not bullish on the economy, even the $1.4Tn is not new money, it’s just a renewed commitment to spend it. This was taken as a dolllar negative in Europe but, “in reality” (such as it is), Fed accounting does not affect our national budget so they can spend this money without impacting US debt but it is a sneaky way to jam the…